The Ultimate Guide To Getting Started With NFTs

In this article you’ll learn how to get started with non-fungible tokens (NFTs).

Whether you’re interested in starting an NFT art collection, trading NFTs like stocks, developing smart contracts for NFT projects, involving yourself in the NFT community or want to understand more about the NFT space, this guide will offer you a valuable entry point.

Please note: This article is for informational purposes only. Nothing contained within this article constitutes investment, tax or legal advice. Consult a professional in all instances.

Contents

- My Introduction to NFTs

- What Is An NFT?

- How Do NFTs Work?

- Why Do People Buy NFTs?

- Where Can You Buy NFTs?

- Buying An NFT Step-By-Step

- Picking Profitable NFTs

- Early NFT Mistakes To Avoid

- Keeping Your NFTs Safe

- Tax and NFTs

- Contributing to the NFT Space

- Recommended NFT Resources

- NFT People and Communities

My Introduction to NFTs

I’ve been interested in crypto since 2017. Bitcoin’s value rose and, like many others, I bought my first coins. As a developer, crypto had been my “thing to look into next” ever since.

In summer 2021, I decided to follow my curiosity further. What made me finally dedicate the time? NFTs.

I’m currently onboarding myself to web3 through investing in NFTs, studying blockchain technology, building decentralised apps on Ethereum and contributing to the crypto community.

Here’s everything I learned while getting started with NFTs.

What Is An NFT?

An NFT is a non-fungible token stored on a blockchain. A token, in crypto terms, refers to an asset. “Non-fungible” means unique. Where a fungible token—like Bitcoin—is non-unique, an NFT can only be assigned to a single owner at any one time. Any one Bitcoin equals any one other Bitcoin. But there’s only one NFT. It’s irreplaceable.

The internet makes information abundant. The cost of replicating a digital asset, like an image file, text document or PDF is effectively zero. NFTs introduce scarcity to digital assets.

With NFTs, we can now see who owns what. No matter how many copies are created, everyone knows who holds the original. When the creator of an asset assigns a unique token to it, ownership is provable in perpetuity. From the initial creation of the NFT to every transfer of ownership thereafter. The blockchain stores this information and it can’t be tampered with.

What Are NFTs Used For?

The most common use of NFT technology, right now, is art. Artists are tokenising 1 of 1 pieces and teams are building profile picture projects at great pace.

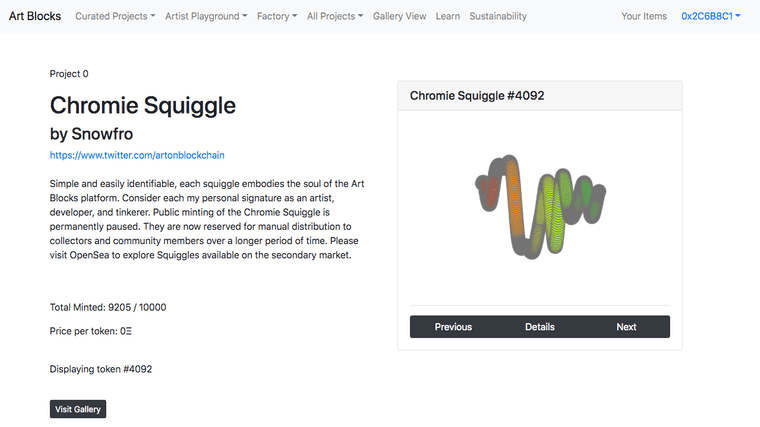

Art Blocks is a collective of generative NFT artists.

Art Blocks is a collective of generative NFT artists.

The former use case is similar to how the traditional art world operates. One original piece of art work, bought by one person, who can then sell the piece on at their leisure. The difference is, the transaction is settled in cryptocurrency and ownership is transferred on the blockchain. Possession is no longer physical, but digital.

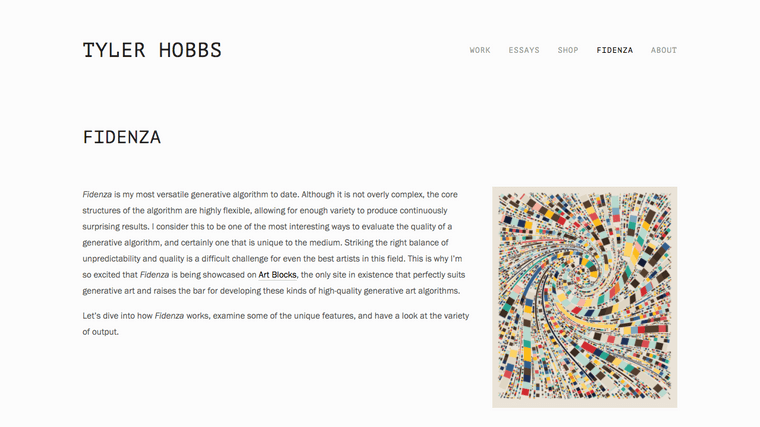

Generative artists like Tyler Hobbs and Brendan Dawes have become successful adopters of NFT technology in this fashion. Artists who can code are finding themselves at home with NFTs. Why? Because it makes sense to assign scarcity programatically when you create art programatically.

Tyler Hobb’s Fidenzas have sold for up to $3.3 million.

Tyler Hobb’s Fidenzas have sold for up to $3.3 million.

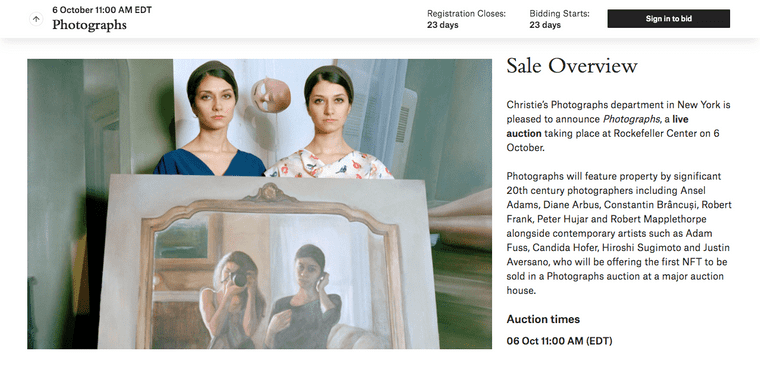

NFTs are a huge boost to the intersection of creativity and code, though not all crytpo art is computer generated. A drawing completed on an iPad or a scan of work created with paint, pencil or pen can be NFT’d too. Even photographs can be NFTs. Justin Aversano’s Twin Flames collection has proven popular amongst collectors, for example.

NFT photograph’s are being sold at Christie’s auction house.

NFT photograph’s are being sold at Christie’s auction house.

Digital art is traded in public and private marketplaces. Owners who truly believe in a project, or want to hold a piece for the long term to maximise returns, may not want to entertain listing their assets at all. As with any market, rarity affects value, and thus price.

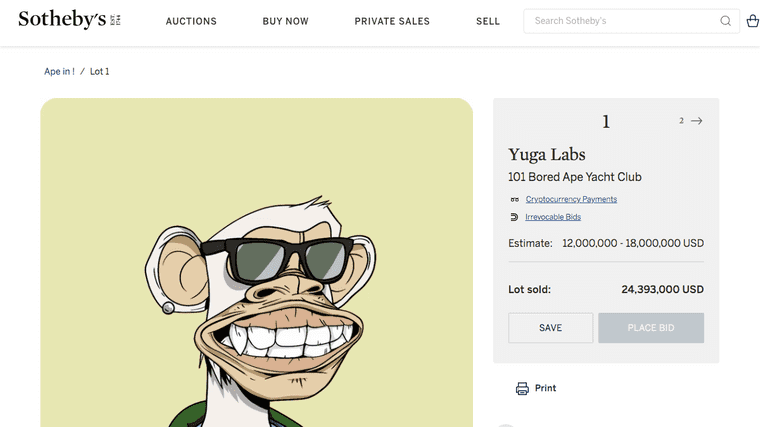

In September 2021, 107 Bored Ape’s fetched $24.3 million at Sotherby’s.

In September 2021, 107 Bored Ape’s fetched $24.3 million at Sotherby’s.

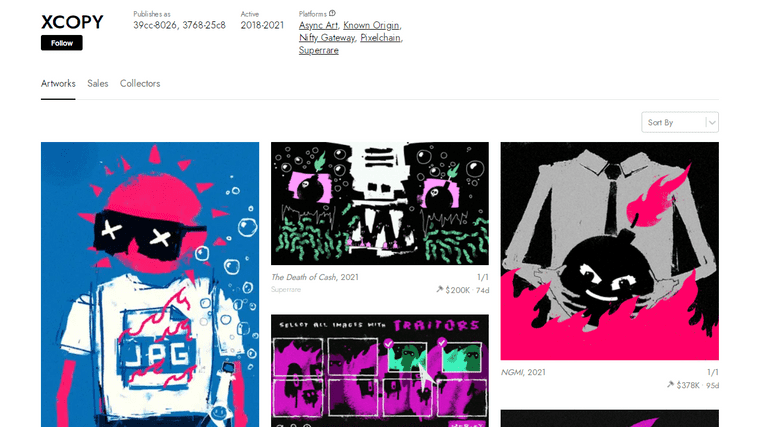

An NFT artist can create multiple editions of their pieces, each edition with its own unique token. Think of this like making a print of an original created physically, but limited and with provable ownership. Crypto artist, XCOPY, uses this mechanic to great effect making ownership more accessible to their fan base. In the artist’s “Afterburn” collection, 870 editions were minted to 870 collectors.

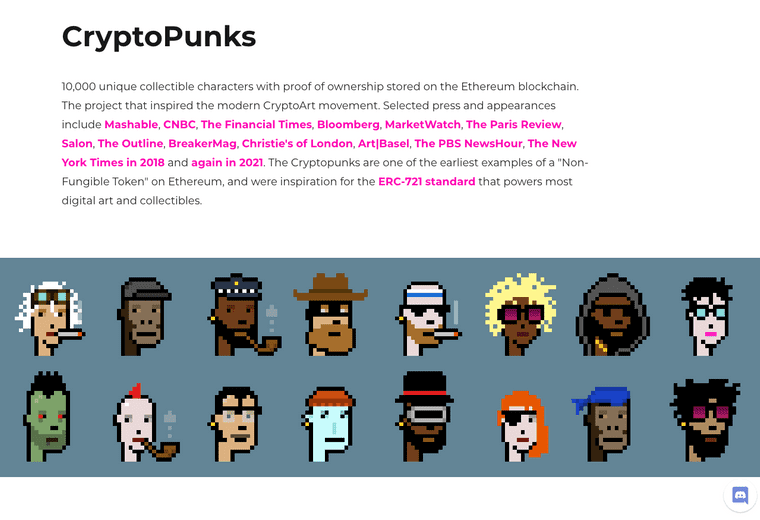

Like most people on Twitter, my introduction to NFTs came by seeing avatars changing. Punks, apes and cats everywhere. Yet profile picture projects (or, “PFPs”) have actually been around for a long time. Larva Labs released CryptoPunks in 2017. A project that’s now considered to be the bluest of blue chip projects in the NFT space, with sales of rare punks well into the millions of dollars.

CryptoPunks was one of the first PFP projects to emerge using NFT technology.

CryptoPunks was one of the first PFP projects to emerge using NFT technology.

A PFP involves a number of randomly generated square images, featuring a person, animal or entity, that one can use as their social media avatar. Some owners go one further and form whole personas around their characters. You can see it as Pokémon cards meets World Of Warcraft; collectables with a social element.

The Pokémon collection unearthed from my parent’s attic. (This might explain my draw to NFTs).

The Pokémon collection unearthed from my parent’s attic. (This might explain my draw to NFTs).

The first NFT that I bought was from PFP collection, Bored Ape Yacht Club. I liked the art, the vibe and the community. It drew me in, but I was still weary of spending good money on a JPEG of a monkey. Still, I went for it. As a programmer, I saw use cases for the mainstream adoption of tokenisation. As someone who likes nice things, I saw a cultural shift towards digital ownership. Overall, I wanted to understand how the project worked.

Bored Ape Yacht Club, a limited NFT collection where your token doubles as membership to an exclusive swamp club for apes.

Bored Ape Yacht Club, a limited NFT collection where your token doubles as membership to an exclusive swamp club for apes.

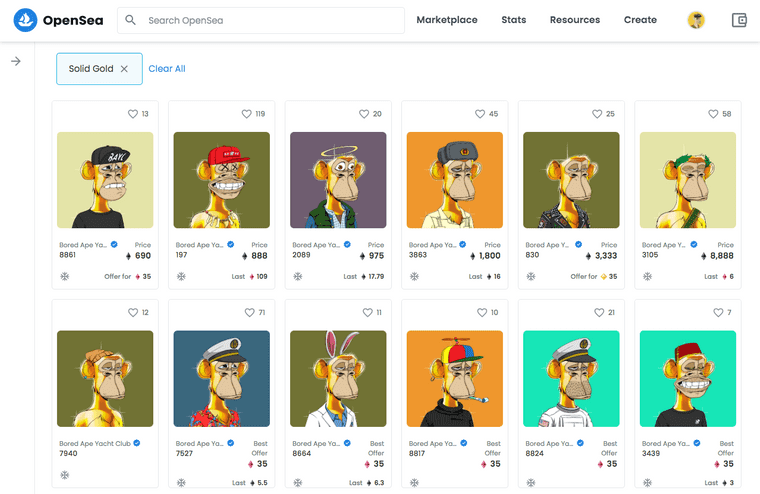

Each ape in the collection has its own specific traits. Randomised and weighted by rarity. For instance, there are 19 different fur types, of which only 46 apes have solid gold fur.

BAYC NFTs with solid gold fur.

BAYC NFTs with solid gold fur.

My purchase of ape #9475 taught me how to buy an NFT. It taught me another lesson too. I listed and sold the art pretty quickly. While making a modest profit of 1 ETH ($3,924 at the time of writing), the project soared to wild heights soon after. The cheapest Bored Ape right now? 35 ETH ($137,353).

With value increases on NFTs that I’ve held since, it’s not all been bad news. NFT markets move fast and I expect continued volatility, on both sides, in the future.

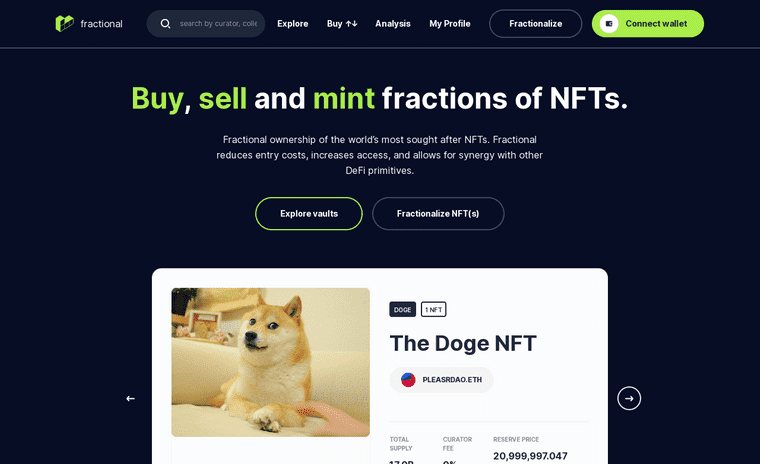

As the price of some NFTs rises beyond the reach of mainstream investors, new ownership angles are being introduced. Tools like fractional.art let users buy, sell and mint fractions of NFTs. For example, collaborators can pool their funds to bid on NFTs as a team. This method ownership is called fractionalisation. If you want exposure to a certain piece, but don’t have the liquidity to become its sole owner, fractionalisation can be your route in.

The fractionalisation offered by fractional.art splits NFTs between multiple owners.

The fractionalisation offered by fractional.art splits NFTs between multiple owners.

The transition to digital art can provide creators with greater discoverability. Being digital native unlocks wider network effects. Artists are no longer displaying their pieces in small galleries, but the largest gallery in the world—the internet.

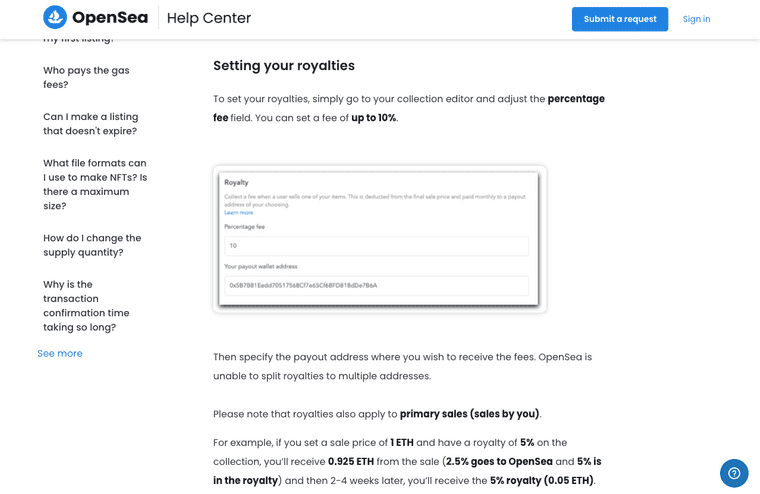

NFTs give artists a better chance of getting paid in line with the value they’re creating, too. Artists can add royalties to their pieces that last forever; paid upon each transaction, not just the first.

OpenSea allows artists to set a percentage of sales to be paid back to them as royalties.

OpenSea allows artists to set a percentage of sales to be paid back to them as royalties.

Let’s say an artist sells something for 1 ETH, with a 2.5% commission fee coded in. If the art sells for 2 ETH next time, the owner makes a 1 ETH profit and the artist gets 2.5% of the sale total (0.05 ETH) deposited into their Ethereum wallet automatically.

There’s upside for collectors, too. NFTs make art more accessible. Those who appreciate art, but wouldn’t go to an art show, have found an entry point into the ecosystem.

On the investment side, the incentives of creator and owner are aligned. As the popularity of an artist, team or project rises, oftentimes, so does the value of the owner’s NFT. And how do creators become more popular? By having the owners of their art promote it.

The internet unlocks owner participation possibilities that weren’t available before. Backing an NFT project with your capital and attention gives you a chance to participate in the upside of its future success.

NFT technology is being used to build win-win landscapes across the creative space.

Other Use Cases For NFTs

NFTs aren’t just for art. The technology can be used in other ways and will change the way we do many day-to-day things in the future. Anywhere that provable ownership records and automated financial transactions are important, is up for grabs.

Here a few examples and predictions:

- Music. Artists use NFTs to raise funds to release albums. As a fan, you own a portion of your favourite artists’ music and can benefit from the upside created by them.

- Ticketing. That football game you’re attending, your ticket’s in your wallet for entry to the stadium. You have a piece of memorabilia that can’t be lost and doesn’t take up physical space. Your club can see that you turned up and can reward you with merchandise for this in the future.

- Charity. Make donations by buying NFTs. Show your affiliation to a cause by holding the token in your public wallet. Increase funds raised through social proof of purchase.

- Property. The house that you own. Instead of the deeds being stored in a solicitor’s filing cabinet, your wallet holds your deed token. No middle-man is required to buy or sell the house, saving both sides of the deal money.

- Accounting. Your services and products are NFTs. Your business transactions are done on the blockchain and the records are public. Tax is less complicated because it becomes automated.

- Education. Enrolment is done with NFTs. Your certifications are NFTs. Leaders of decentralised schools learn and build at the same time. Schools provide ownership to students who contribute beyond the modules they take. Built-in job prospects are available to alumni via DAO projects.

I believe all these things will be disrupted by crypto in the future.

How Do NFTs Work?

This section will give you a technical overview of how NFTs work. It’s not just for developers. Improving your understanding here will save you time and money should you choose to invest in an NFT project.

Web3

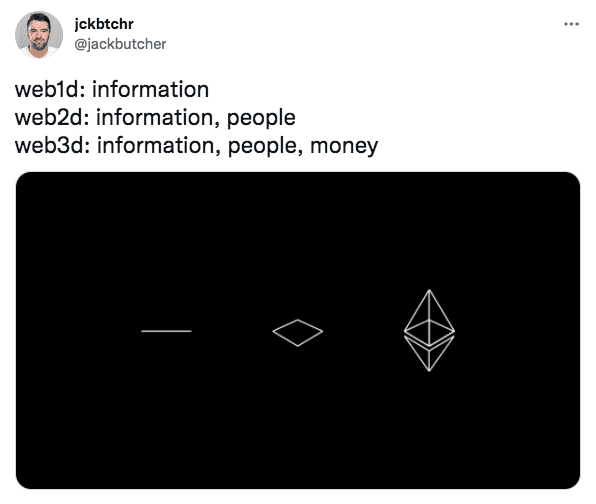

NFTs are a part of the progression of the web from version 2 to version 3. As the name insinuates, there was a prior transition from web1 to web2, too. This happened around 2004, when I was 17 years old.

While I experienced the switch to web2 as a consumer, I missed it professionally. I didn’t understand what was happening under the hood. As a digital worker since 2009, it’s obvious to me that the web3 evolution is happening now.

Jack Butcher’s precise description of the web’s journey.

Jack Butcher’s precise description of the web’s journey.

Listed below are the characteristics of each version of the web:

- Web1. The first iteration of the web. Information focused. HTML based.

- Web2. The state of play now. Centralised. Interactive. Social interaction. Ad revenue driven.

- Web3. Where we’re going. Decentralised. On chain records. Stateful. Native payments. Fewer middle men. Value driven.

Ethereum

Ethereum is a blockchain co-founded by Vitalik Buterin. Unlike Bitcoin (or “BTC”), Ethereum’s capabilities go beyond value exchange. Decentralised applications, of all kinds, can be built on Ethereum using smart contracts.

The native cryptocurrency of Ethereum is ETH (or “Ether”), symbolised as “Ξ”. ETH is only second to BTC in market capitalisation at the time of writing.

Most NFT projects are built on top of Ethereum and are priced for sale in ETH.

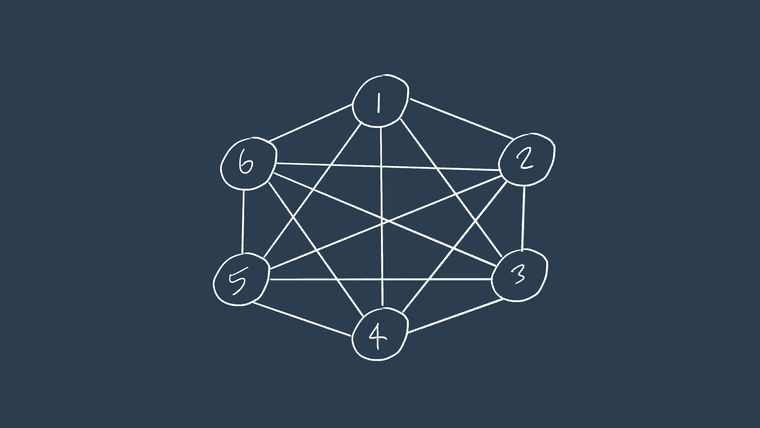

Blockchains

NFT ownership is provable because records are held on a blockchain. A blockchain is a series of computers (referred to as nodes) around the world. This is what makes crypto technology decentralised. Records aren’t stored in one central place, like a fileserver in a cabinet, records are stored everywhere, by everyone.

6 connected nodes forming a blockchain.

6 connected nodes forming a blockchain.

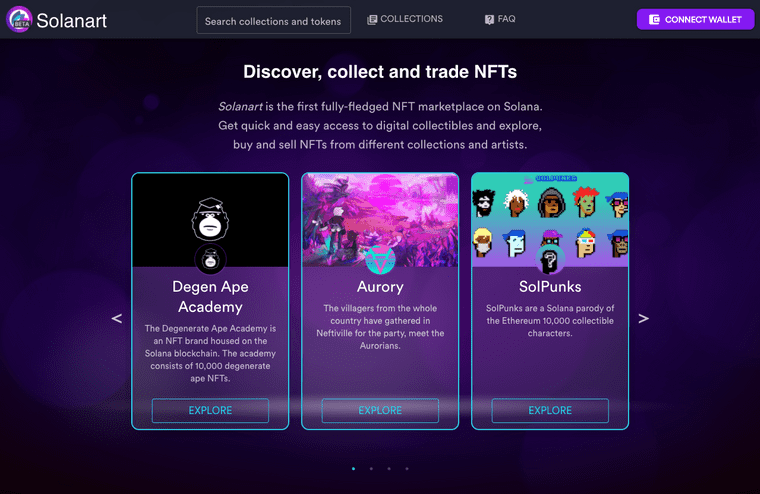

A blockchain is a distributed ledger of transactions, and it’s accuracy is assessed by consensus. Records of token ownership and exchange are stored on these blockchains. Although NFTs are typically built on Ethereum, additional chains are emerging. It’s possible to create NFTs on Solana now too, with the primary benefit being, cheaper transaction (or “gas”) fees.

Solanart is the Solana chain’s version of OpenSea.

Solanart is the Solana chain’s version of OpenSea.

On Ethereum, nodes in the blockchain use a consensus protocol called proof-of-work (or “PoW”) to agree on the correct current state of information, however, this algorithm will be phased out soon in favour of the more scalable proof-of-stake (or “PoS”).

If a speculator believes in one particular blockchain as a whole, they can back the entire protocol by buying its token, as opposed to, or as well as, a particular NFT stored on it. For instance, by buying ETH if you’re bullish on the Ethereum blockchain and/or SOL if you’re bullish on the Solana blockchain.

The ERC721 Smart Contract Standard

An NFT is created when it’s minted by a smart contract. A smart contract is a piece of code that self-executes a transaction, or transactions, on a decentralised blockchain. Assets of the buyer and seller are swapped irreversibly by code, without the need for 3rd party involvement. Imagine a computer program exchanging your house deeds for the buyers funds, instead of a solicitor.

Minting an NFT means creating it for the very first time and becoming its original owner. In Ethereum terms, smart contracts are written in the programming language Solidity. Solidity developers are in high demand due to the increasing interest in NFTs.

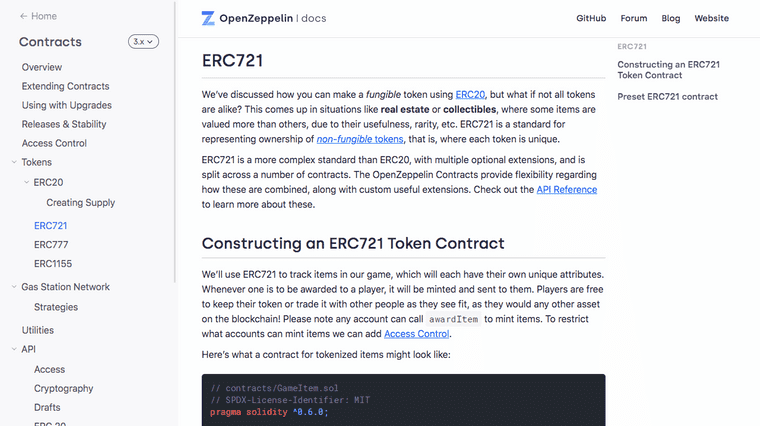

The ERC721 standard is a boilerplate Solidity smart contract for the minting and management of NFTs within a collection. It provides functionalities to create a token, transfer a token from one account to another and to get the current balance of tokens available in a set; amongst other utilities inspired by the contract written by Larva Labs for CryptoPunks.

The ERC721 standard documentation on OpenZeppelin.

The ERC721 standard documentation on OpenZeppelin.

Most developers take this template and build additional functionality on top of it depending on the specific needs of their NFT project. There are three primary benefits to this approach:

- Developers can get an NFT project off the ground quicker because they don’t have to reinvent the wheel.

- Using a standard firms up the way developers should be building things. This ensures familiarity when a new developer enters a project at a later date.

- The longer a standard template is used in the wild, the greater confidence people can have that it won’t be exploited.

You can check out the ERC721 standard smart contract core functionality on OpenZeppelin.

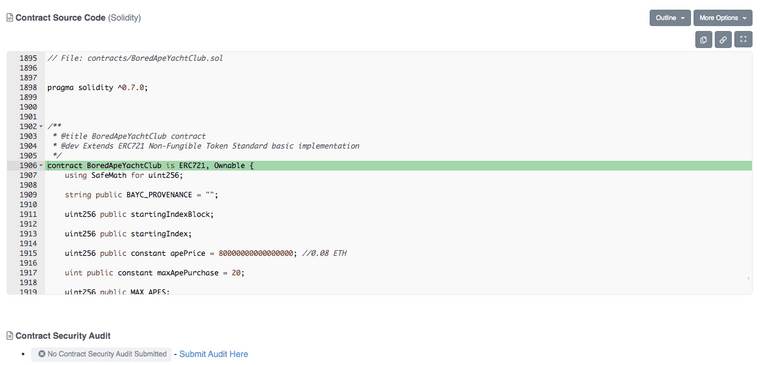

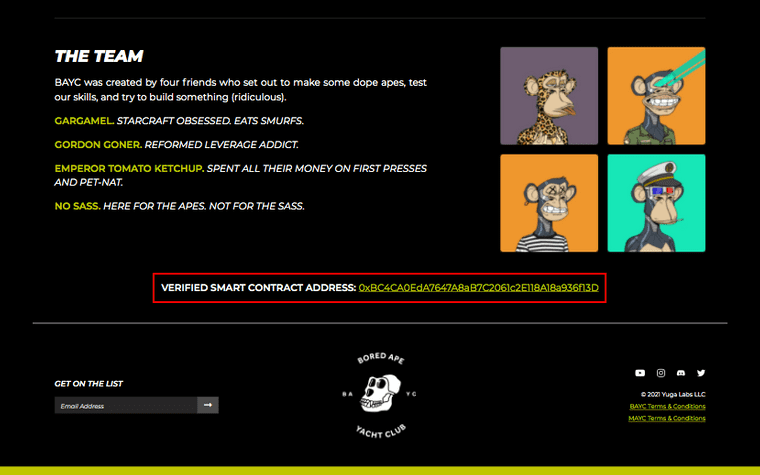

All smart contracts used by NFT projects are open source and immutable. You can view the code of any project you’re interested in minting, or learning from on Etherscan. Once deployed, the code can’t be changed. Here’s the smart contract for the Bored Ape Yacht Club by Yuga Labs.

BAYC’s ERC721-based smart contract code.

BAYC’s ERC721-based smart contract code.

Transaction Fees

Each time you transact with a blockchain, you use its energy. When minting, buying and selling NFTs on Ethereum, nodes on the blockchain compete to be the first to solve the PoW algorithm to gain the right to process your transaction. Because doing so comes with a financial reward. Ethereum miners (the nodes that run the PoW algorithm) receive 2 ETH per completed block at the time of writing.

Why are transaction fees necessary? To prevent misuse of the blockchain. If it were free to transact, the system would become jammed with infinite requests. No one could buy NFTs. So to solve this problem, gas is charged on each transaction that involves writing to a smart contract. This includes the minting and trading of NFTs. Reading data from the blockchain costs no gas. For example, viewing all of the NFTs owned by someone on OpenSea.

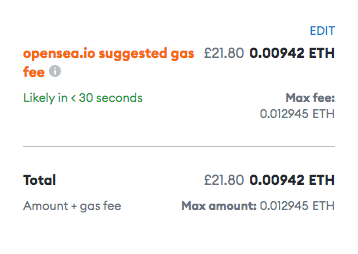

This means that each time you buy or list an NFT for sale on a marketplace, you will need to pay a gas fee. For example, an NFT that you purchase for 1 ETH, may require 0.1 in additional ETH to cover gas. Listing an NFT for sale isn’t free either. Delisting, too, should you change your mind about selling.

Gas is perhaps the hardest concept to grasp when getting started with NFTs. But it’s important that you understand the additional costs involved before you invest in anything.

Gas is measured in Gwei, a term for a very small amount of ETH. 1 Gwei is equal to 0.000000001 ETH. The exact amount of gas you’ll pay for a transaction fluctuates. It depends on the smart contract action you’d like to perform and the current network traffic. You won’t know exactly how much gas you’ll pay until the transaction has been completed. However, wallets like MetaMask give you a maximum potential gas cost before you confirm a transaction. Gas can also be used when a transaction doesn’t go through. For instance, trying to mint an NFT when the supply of tokens has run out.

MetaMask displays estimated gas cost and transaction time pre-confirmation.

MetaMask displays estimated gas cost and transaction time pre-confirmation.

Gas prices fluctuate because they’re part-determined on a most willing to pay basis. If someone wants their transaction to go through fast, they’ll pay a high gas fee. (What constitutes a “high” gas fee depends on the function being called and network traffic at the time.) This can create a problem referred to as gas wars. When many projects launch at one time—or a particularly popular project launches—the price of gas goes through the roof. Because failed transactions cost gas too, the excitement of minting can soon lead to disappointment.

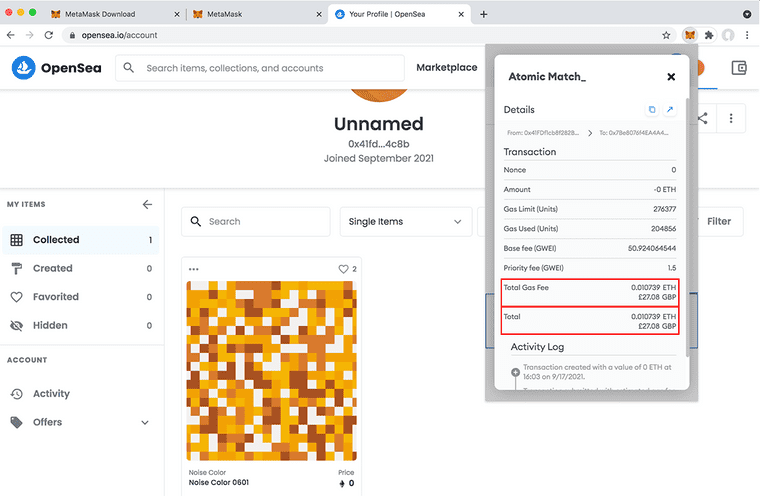

The total cost of an NFT purchase includes gas.

The total cost of an NFT purchase includes gas.

Sometimes, lots of transactions get submitted with levels of gas attached that have no chance of going through before a project sells out. Sometimes poorly optimised smart contracts can lead to hopeful minters paying more gas than they should.

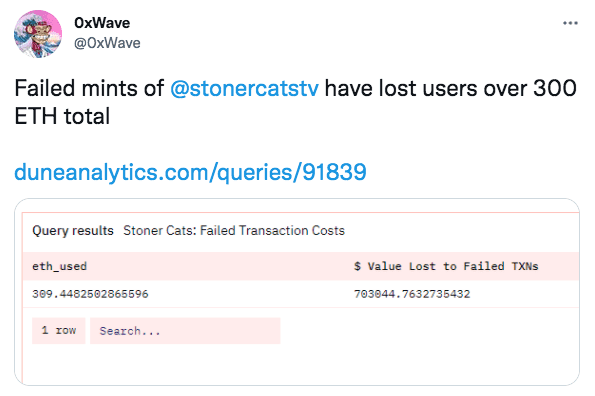

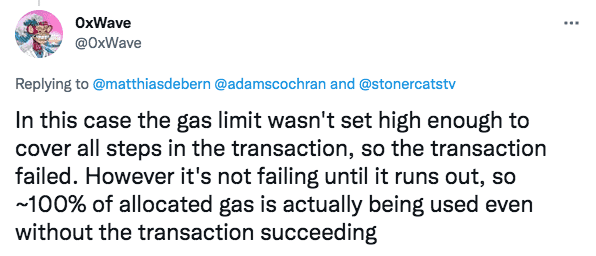

Stoner Cats founder, Ashton Kutcher, discusses the project’s gas problems on Twitter.

Stoner Cats founder, Ashton Kutcher, discusses the project’s gas problems on Twitter.

In July 2021 the launch of Stoner Cats saw 100s of hopefuls spend gas with no NFT to show for it. Over 300 ETH in total. Stoner Cat’s later pledged to refund the gas lost by users who experienced “Out of Gas” errors when minting. An error that, according to a technical discussion on Twitter, could have been avoided.

300 ETH was lost (and later repaid) during minting of Stoner Cats’ launch.

300 ETH was lost (and later repaid) during minting of Stoner Cats’ launch.

It’s vital that smart contract developers pay attention to gas efficiency. The aim should be to use as little gas as possible when transacting. An error in a smart contract can lead to real losses when users attempt to mint NFTs.

Twitter user 0xWave explains Stoner Cats’ technical issues.

Twitter user 0xWave explains Stoner Cats’ technical issues.

From the consumer side, prior to jumping in to mint the latest project, remember that the true cost of minting an NFT is:

(mint cost * number of tokens) + gas cost of the transaction

Make sure you know what you’re spending and be prepared to lose some funds without success.

With gas issues becoming more evident as wider adoption of NFTs is reached, there’s hope that Ethereum’s migration to 2.0 (including PoS) will solve these problems.

ETH2 promises a more scalable, secure and sustainable Ethereum.

ETH2 promises a more scalable, secure and sustainable Ethereum.

In the meantime, layer 2 scaling solutions like Polygon are reducing transaction fees on Ethereum by increasing the capabilities of the main chain as is.

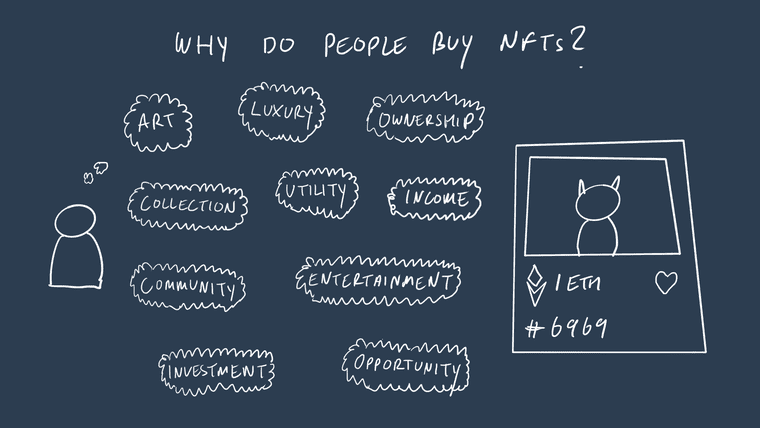

Why Do People Buy NFTs?

NFTs are one of those things that you don’t get until you do. When you adopt any fast-moving technology, you often look silly before you look like a genius; “Why can’t you right click and save the image instead of buying it?”—a common rebuttal until it really clicks. Your friends and family might not get it yet, but there are a host of reasons why people buy NFTs.

Art

Someone might buy an NFT for the appealing art attached to it. They might want to display it in their homes in a digital frame or on their Apple watch so they can appreciate it all day.

A Mutant Ape NFT as an Apple Watch background image.

A Mutant Ape NFT as an Apple Watch background image.

Buying something for its looks is sometimes difficult to understand broadly because beauty is in the eye of the beholder. When it comes to assessing NFT art—or art in general—it’s important to remember that value is subjective.

What you like, someone else might not. Just because something is valuable to you, doesn’t mean that it’s valuable to someone else. If you’re happy with the way an NFT looks, irrespective of how its price might fluctuate, you’re buying primarily for the art.

With this said, popular culture is important to follow, too. This is what drives wider acceptance and often, higher prices. Spotting “good” NFT art from “bad” NFT art comes with experience as your taste develops.

Luxury

With the price of some NFTs in the millions and few of the most desirable projects coming in under the thousands, we can start to class these digital assets as luxury items. In some circles, the Rolex is being displaced by the Apple Watch with NFT background for ”flexing” purposes.

Though the initial price of an NFT is determined by the artist, the ongoing price of an NFT will be determined on the secondary market via supply and demand. If there’s more supply than demand, prices go down. If there’s more demand than supply, prices go up. Just like traditional markets.

You can compare an NFT release to brands like Supreme releasing clothes. The limited nature number of tokens represents the limited number of t-shirts, hoodies or trainers. Scarcity drives price. Because people want items that other people don’t have.

Fashion brand Supreme are notorious for their limited drops.

Fashion brand Supreme are notorious for their limited drops.

The luxury goods industry was worth an estimated £349.1 billion in 2020. If trends towards digital continue, I expect NFTs to capture a lot of this value. People often buy things, partly, or entirely, for what their purchase signals. Because of the story it tells others and the story it helps them tell themselves.

BAYC hoodies to be used in Decentraland were gifted to Ape owners.

BAYC hoodies to be used in Decentraland were gifted to Ape owners.

Why would someone buy a £1,000,000 NFT over a £100 one? For the same reason they’d buy a £500 Gucci t-shirt over a £10 H&M one. Luxury desires transcend the physical world. Especially now you can wear your clothes in the Metaverse.

Collection

Humans like to collect things. Beanie Babies, Pokémon cards, and football stickers. My sister and I had them all. My Dad before us was into stamps and vinyl records.

We know physical collection is a thing. But what about digital collection? Well, I sure spent a lot of time gathering items in World Of Warcraft.

Exclusive trainers are purchased by some collectors never to be worn. See, Yeezy’s and Jordan‘s. We’re seeing this happen in the NFT space too, with projects launching merchandise for token holders only. This highlights an interesting paradigm; digital and physical items being collected together from the same brand. 2 frontiers for fans to collect on. 2 ways for brands to monetise.

@ape9331 proudly shows off their hats in a protective display case.

@ape9331 proudly shows off their hats in a protective display case.

There are a number of reasons that people collect things. From learning to relaxation, from pride to recognition, from nostalgia to the diversification of wealth. Collecting provides a purpose for many and NFTs offer that in the digital world with an added layer of indisputable ownership.

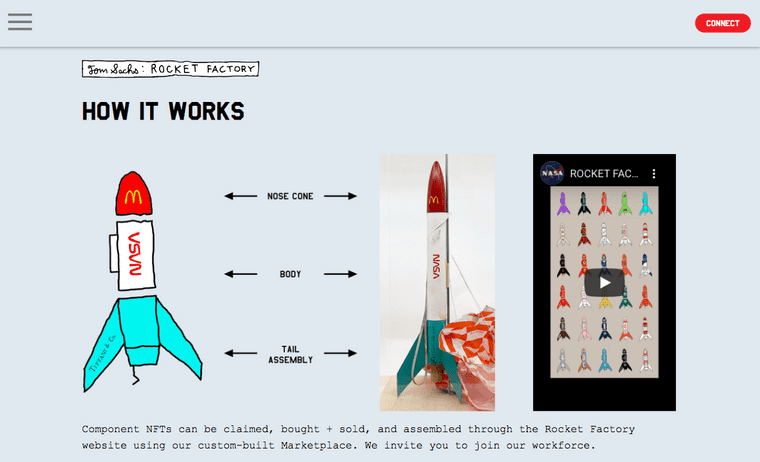

The pull to accumulate things from sets transfers seamlessly from the Premier League sticker book to Tom Sach’s Rocket Factory. Buying 1 NFT often leads to buying more. Whether for the gamified rewards or to increase exposure to a particular favourite project.

Tom Sach’s Rocket Factory released rockets broken into 3 parts (nose cone, body and tail assembly) as NFTs for collectors to assemble.

Tom Sach’s Rocket Factory released rockets broken into 3 parts (nose cone, body and tail assembly) as NFTs for collectors to assemble.

People will buy NFTs for the sake of collecting them.

Utility

NFTs can offer utility to their owners. For example, purchasing one NFT can lead to further NFTs being sent to your wallet in the future. This is known as airdropping. Creators do this as a show of support to their owner-base. Like a dividend from a company you’ve invested it.

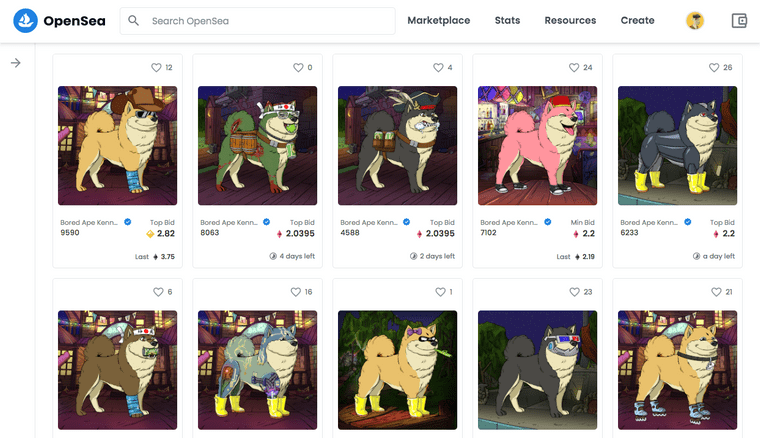

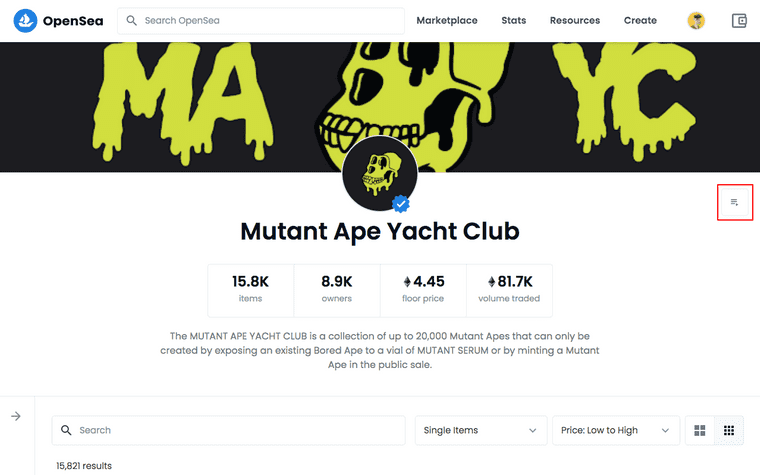

These airdrops can be worth something substantial. In August 2021, the Bored Ape Yacht Club gifted owners a mutant ape from their new collection, the Mutant Ape Yacht Club. This, completely free NFT, has a floor price of ~4 ETH at the time of writing. A $15,763 gift. Owners earlier received a free NFT from the Bored Ape Kennel Club collection too.

BAYC provided utility to their holders by gifting them a free dog.

BAYC provided utility to their holders by gifting them a free dog.

Utility comes in other forms too. Like access to a gated community, in-person events or a pass to mint something else in the future. Many NFTs are assets you can do things with, besides trading.

Opportunity

Owning a certain NFT could be your introduction to new opportunities. Changing your avatar to your NFT, on Twitter or Discord, signals trust and makes you part of an exclusive club. It says, “We are alike” to your club comrades. This can lead to new work or partnerships that you wouldn’t have otherwise had if you didn’t own the NFT.

Many NFT communities have participants involved with in-demand skills. Buying in is a way to network with them. Because the contents of your crypto wallet can act as credentials.

Ownership

The good feeling of owning a physical item can be felt of owning a digital item. Some in society’s digital native generations enjoy owning NFTs as much as, if not more than, houses, cars and watches.

Furthermore, many NFT projects offer intellectual properties rights to token owners. This can be useful when an NFT brand takes off because owners are legally allowed to use their NFT however they see fit commercially.

In the short term, this might mean printing the graphic on a t-shirt. In the longer term, this might mean earning royalties from your NFTs’ usage in a feature film.

Some NFT projects may convert to a decentralised autonomous organisation (or “DAO”). This crypto-mechanism enables community-based ownership of an entity. NFT buyers find this appealing when they’re contributing value to the community and have confidence in the project’s future prospects. Because they can benefit from any upside achieved as a part-owner.

Community

Nearly all NFT projects bring with them community. Discord being the industry standard platform of choice. These chat servers are usually part public, part private, with some gated elements exclusive for token owners.

Discord is the chat tool of choice for many crypto communities.

Discord is the chat tool of choice for many crypto communities.

Here’s why community is important in the world of NFTs:

- Access to information. For instance, what time the next cool project is minting or what’s on the horizon for an existing project. These ”alpha” tips can help inform your investment decisions.

- Access to opportunities. Collaborations are born when sharing space with like-minded people. Many NFT investors are becoming builders of their own projects, which creates opportunities within communities for designers, developers and marketers to team up.

- Learn from others. The people in NFTs are often as open as the source code in their smart contracts. There’s an innate willingness to share in these communities. Beginners are welcomed and there are no stupid questions.

- Teach others. It’s fulfilling to teach others who’re a step or two behind you. I was grateful for the patience of others when I started in NFTs and I’ll be sure to pass my patience along, too.

- Peace of mind. It’s comforting to get a second opinion on something. Especially your art, code or investments. Any due diligence you miss can be picked up by your community-mates and save you from costly mistakes.

- Teamwork. Communities can choose to invest in NFT projects together. Individually, based on community sentiment or communally through fractionalisation. A shared win is a bigger celebration and a shared loss is a lesser burden.

Investment

NFTs aren’t just about the art. People like to make money. And people really like to make money that isn’t directly linked to spending their time. Like investing in a company on the stock market, investing in NFT projects can offer this.

Minting an NFT gives you the chance of getting something worth more than what you paid for it. Most projects mint at a flat rate cost (though other pricing methodologies are used too, see: English auctions, Dutch auctions and bonding curves) meaning you could obtain a rare NFT for the same price as a common one. Akin to pulling a Charizard from a £2.50 pack of Pokémon cards. In this sense, it’s digital art roulette.

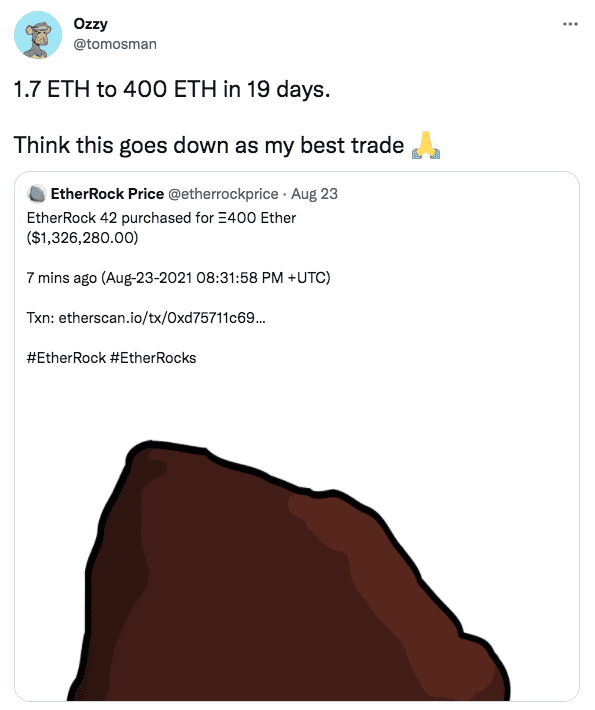

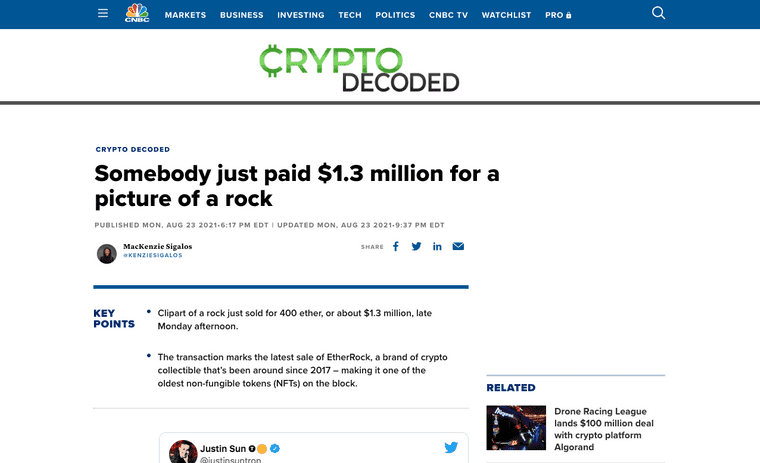

The speculative aspect of NFTs is endearing to a broad audience. In August 2021, the founder of Shiny Object Social Club, Tom Osman, flipped an Ether Rock NFT for a $1.3 million profit in 19 days.

These stories—though few and far between—make mainstream headlines, thus enticing more people to try their hand at trading NFTs.

Big NFT sales make for great headlines in the media.

Big NFT sales make for great headlines in the media.

The value of NFT projects as a whole can go up and down based on news, fundamentals, and market sentiment. If an investor feels a project is undervalued, they may choose to buy NFTs from it to later sell for a profit. Conversely, if an investor isn’t liking a project they hold anymore, they’re free to exit their position by selling their tokens.

NFT projects offer a new asset class to investors who wish to deploy their capital across a wider range of resources. Those who hold strong beliefs about the future success of cryptocurrencies, in general, might also buy NFTs.

Income

Some NFT projects offer holders income through ERC-20 token assignment. An ERC-20 token is different to an ERC-721 token in that it’s fungible. Meaning that it’s more like a currency than a collectible.

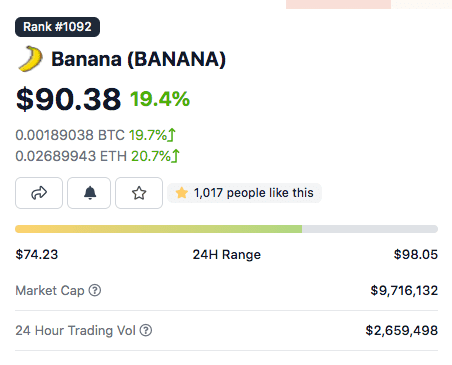

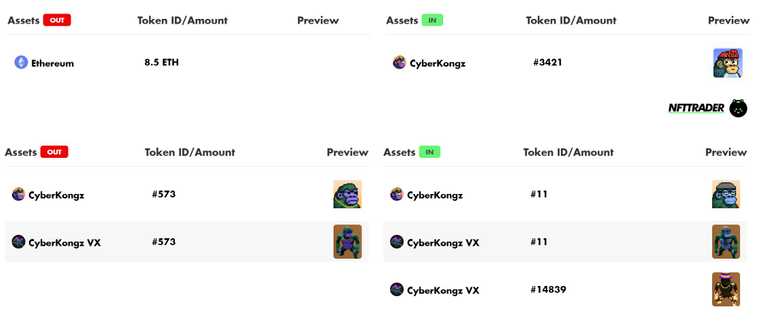

Projects like CyberKongz offer holders of their genesis NFTs 10 $BANANA tokens per day as a reward. The benefit to the project is that people holding their NFTs drives up the value of the collection. The benefit to the holder is that the tokens have a monetary value.

Screenshot of Banana token value chart from CoinGecko 4th October 2021

Screenshot of Banana token value chart from CoinGecko 4th October 2021

$BANANA tokens come with in-world utility. Owners can rename their characters, add to their biography and unlock gated channels within Discord. These mechanisms categorise the tokens as utilities as opposed to securities (see the Howey Test), which works in favour of innovation but comes with little consensus regarding regulation.

The lines can be blurry here. In October 2021, popular NFT marketplace OpenSea delisted the DAO Turtles project citing a violation of their terms of service after they promised passive income to holders. The issue? The guarantee of income with the lack of utility attached.

It’s important to know what type of token you’re being offered as utility and security tokens are treated differently and may require additional disclosure as a consumer depending on laws in your jurisdiction. Nonetheless, holding an NFT can offer an income stream to its owner through an in-world currency that can be swapped into ETH and then into fiat.

Entertainment

Gaming is a great use case for NFTs. Imagine a digital world, like World of Warcraft, but instead of your legendary sword being stored in-game (centralised), it’s stored on the blockchain (decentralised). Your sword is an NFT with provable ownership and trading functions, no one, not even the game developer, can take it away from you. Unless they pay you for it of course.

NFTs in gaming opens up inter-game transferability options, too. For example: Will we see your hard-earned Call Of Duty weapons being portable to Fortnite in the future? I think so. The benefit to the game developer is user acquisition, the benefit to the game player is earning clout once and showing it off twice.

People will buy in-game gold for real money, so they’ll absolutely buy NFT skills, outfits and weapons to boost their in-game characters.

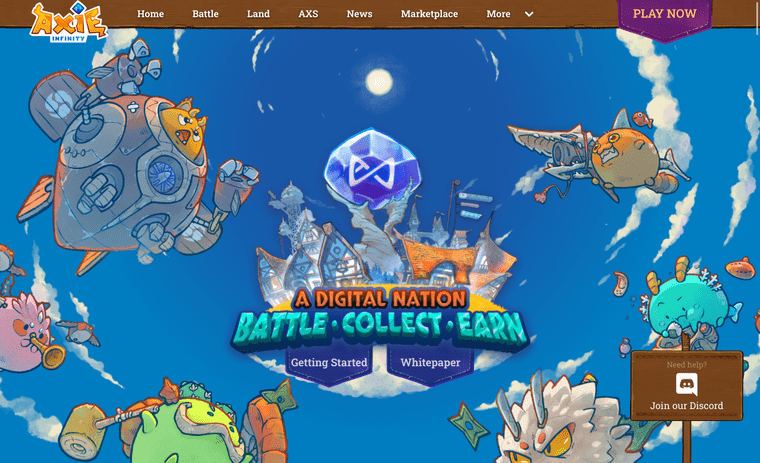

In addition, people are buying NFTs to participate in play to earn games. Axie Infinity, whose platform generated an approximate revenue of $364 million in August 2021, gives players a chance to make money while they defeat monsters and breed their characters.

Axie Infinity uses NFT technology to offer play to earn gaming.

Axie Infinity uses NFT technology to offer play to earn gaming.

Finally, there’s speculation as entertainment. The £100 that you’re happy to risk on the poker table for a good time might now be your NFT budget. Just remember to only play with what you can afford to lose.

Where Can You Buy NFTs?

If you’re looking to pick up your first NFT, here are some places you can buy one from.

NFT Marketplaces

The easiest place to buy your first NFT is from a secondary marketplace. It’s less competitive than minting so provides a softer entry.

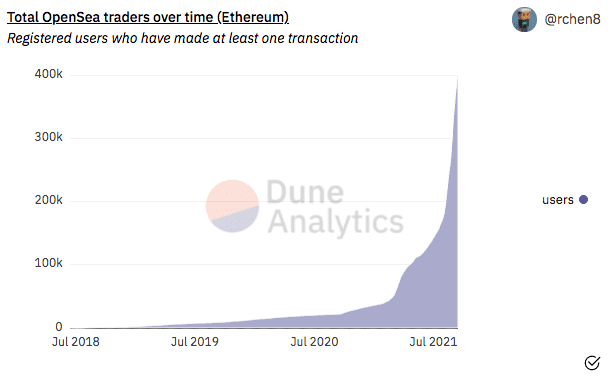

OpenSea is the biggest NFT marketplace. On the day of August 29th 2021, the platform recorded a trading volume of £322 million over a 24-hour period. Moreover, the number of people who have made at least one trade is growing fast, with over 350,000 users having met this criterion on OpenSea by early September. This growth tracks with the wider interest in NFT technology and highlights the potential size of the market to be uncovered.

A graph showing the number of registered users on OpenSea who have made a least one transaction.

A graph showing the number of registered users on OpenSea who have made a least one transaction.

I bought my first NFT on OpenSea and continue to use it to trade on the secondary market. Most people getting started with NFTs do the same.

Other NFT marketplaces include:

Project Minting Websites

A project minting website is an app that interacts with the smart contract of an NFT project. These websites are referred to as dApps, standing for “decentralised applications”. The decentralised part is the transactional portion on the blockchain.

Project minting websites will always have a front-end, the part you interact with in the browser, and a back-end, the smart contract that creates your NFT.

Unlike a secondary marketplace, where NFTs from multiple projects can be purchased, buying NFTs this way is project-specific. And when they run out, there aren’t (typically) more made available.

Minting through a project’s own website is often stressful for buyers as the best projects sell out fast. Seeing the number of tokens remaining plummet before your eyes is the ultimate ”FOMO” generator. Less popular projects take more time to sell out.

Aside from offering people the chance to buy NFTs, project minting websites are used to present the team’s vision. You can find information here to help you decide whether to invest or not. Such as the project roadmap, who’s involved in the project and the price/availability of tokens.

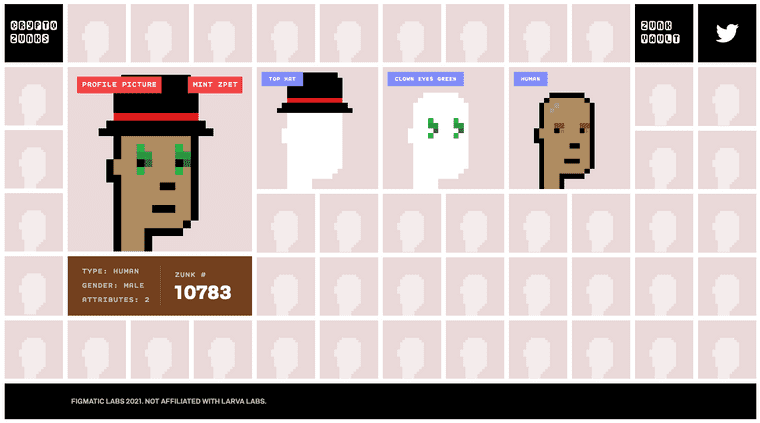

The CryptoZunks website, showing NFTs held and the option to mint a further free NFT.

The CryptoZunks website, showing NFTs held and the option to mint a further free NFT.

Developers build project minting websites to offer a user-friendly way to purchase their NFTs. Because people are used to interacting with apps in the browser and less so with smart contracts on the block chain directly. A well put together, branded user interface provides a familiar purchasing experience, builds trust and encourages investment.

If you choose to buy an NFT through a project’s minting website, you’re relying on the team’s developers to ensure the front-end communicates effectively with the smart contract. Developers should set up automated tests for their smart contracts, using tools like Hardhat and Mocha, to ensure an error-free buying experience.

Direct From Smart Contracts on Etherscan

NFT collectors can mint directly from the project’s smart contract on Etherscan. This means bypassing the project’s custom front-end and going straight to the back-end on the blockchain. Technically, you’ll be using Etherscan’s front-end instead. This isn’t straightforward for your first purchase, but I’d recommend becoming familiar with this method soon after.

Every smart contract deployed live to the Ethereum mainnet has a unique address. You can usually obtain an NFT project’s smart contract address from their website, Discord or social media accounts. It’ll look something like this:

The BAYC website showing the project’s smart contract address.

The BAYC website showing the project’s smart contract address.

Once you have the contract address, you can mint NFTs from it using the GUI within Etherscan—a platform tracking all smart contract transactions on the Ethereum blockchain. You’ll also have access to the smart contract’s public read and write functions.

Appending https://etherscan.io/address/ with the smart contract address you’d like to mint from will let you view its information. The link to the BAYC smart contract, for example, would be https://etherscan.io/address/0xBC4CA0EdA7647A8aB7C2061c2E118A18a936f13D.

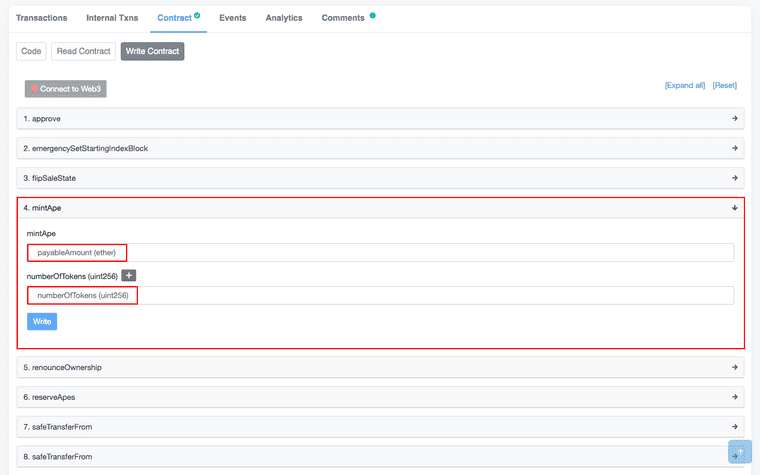

To buy an NFT, you’ll need to head over to the “Contract” tab and click “Write Contract”. Here’s a link that will take you to this section of the Bored Ape Yacht Club (or “BAYC”) smart contract. (Remember this is just an example and you’ll need to find a project with available NFTs. We can’t mint apes anymore, unfortunately!).

You’ll find any mint function of a smart contract in the “Write Contract” tab.

You’ll find any mint function of a smart contract in the “Write Contract” tab.

Next, you need to locate the minting function. In the BAYC smart contract, the minting function is named mintApe. It’ll be named differently in other projects, but should have a reference to minting. This function takes 2 parameters, payableAmount and numberOfTokens. Because, at the time of minting, we knew that apes were priced at 0.08 ETH each, if we wanted to mint 1 ape, we’d enter 0.08 ETH in the payableAmount field and 1 in the numberOfTokens field. If we wanted to mint 2 apes, we’d use 0.16 ETH. And so on and so forth, depending on the project’s maximum number of mintable tokens per transaction.

When minting direct from smart contracts on Etherscan it’s vital that you send the right amount of Ether. Otherwise, your transaction will fail and you’ll still pay gas.

Note that you can only mint this way when there are tokens left to be minted. A project that is sold out can only be bought from on the secondary market.

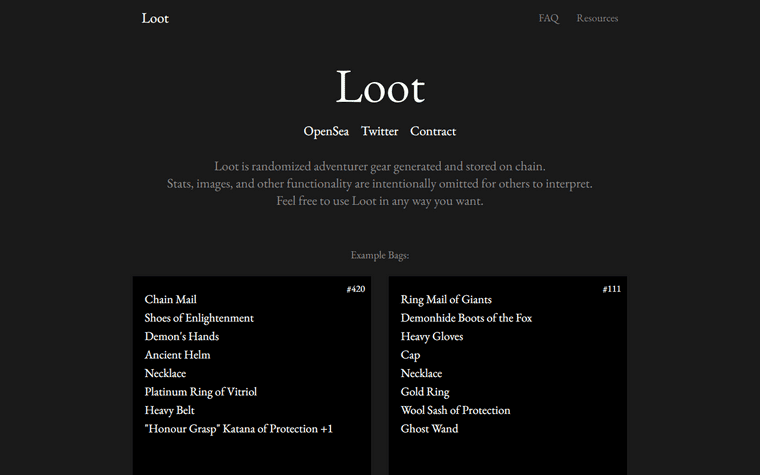

Some teams, especially free to mint projects, like Loot, only circulate this method of minting on launch; bypassing any custom front-end altogether. Minting on free to mint terms means claiming an NFT as opposed to purchasing one, with the only cost being gas.

The Loot project pointed claimers to their smart contract to mint.

The Loot project pointed claimers to their smart contract to mint.

I’d not recommend minting from a smart contract on Etherscan when buying your first NFT. It’s not overly intuitive and things can go wrong (see token and Ether quantities). However, there are potential advantages once you’re comfortable. For instance, you might be able to send a transaction quicker using the Etherscan GUI compared to a project’s minting website. This can give you a better chance of getting an NFT you want when quantities are scarce. And from a technical, due-diligence perspective, seeing the code behind the project you’re investing in can put you at ease.

Buying An NFT Step-By-Step

Here’s how to buy an NFT step-by-step. Please tread carefully as there’s real money involved in this process. We’ll walk through buying an NFT on OpenSea with Ethereum and MetaMask as this is the easiest way to get started.

Buy Ethereum On A Crypto Exchange

To buy NFTs you need currency. For this tutorial, your currency is Ethereum. You can buy cryptocurrency on websites that will exchange it for your fiat currency. These sites let you to trade between cryptocurrencies too, like a bureau de change for digital money.

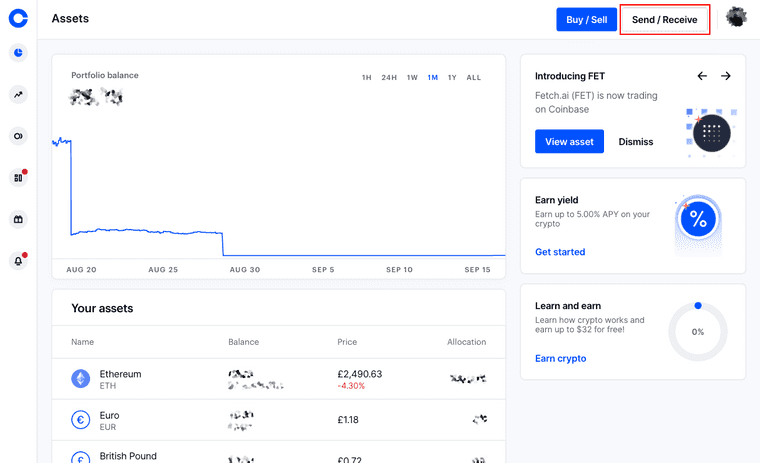

You can buy ETH from Coinbase.

You can buy ETH from Coinbase.

I’ve used Coinbase since 2017 to deposit money by bank transfer to trade for cryptocurrency. It has the cleanest user interface of the popular exchanges, making it a good place to start for beginners.

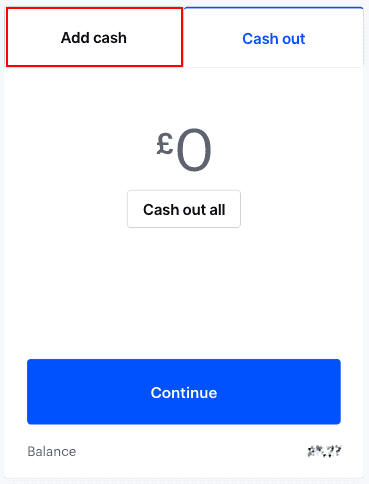

After you’ve created and logged in to your Coinbase account, the first step is to add cash by bank transfer. Funds usually arrive within minutes, but your initial deposit can take a while longer.

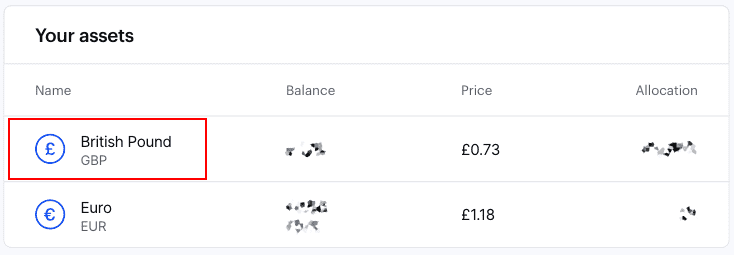

Step 1: Click the currency you want to deposit in.

Step 1: Click the currency you want to deposit in.

Step 3: Send a bank transfer to Coinbase for the amount you want to invest in Ethereum.

Step 3: Send a bank transfer to Coinbase for the amount you want to invest in Ethereum.

Once you’ve deposited, buy some Ethereum. The symbol is ETH. Like traditional currency pairings, how much crypto you’ll get for your fiat will depend on the exchange rate at the time.

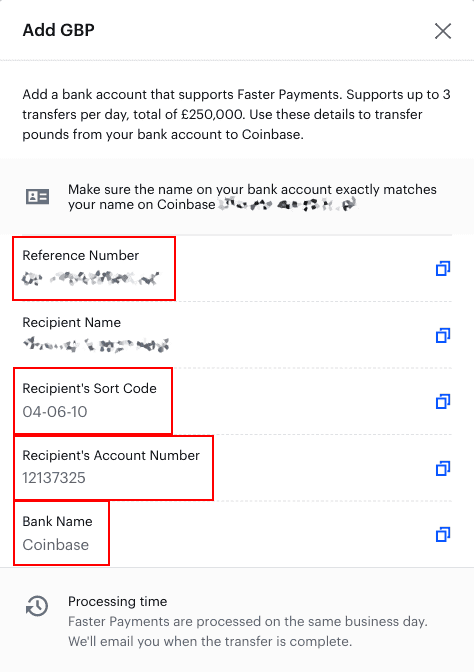

Step 4: Click the “Buy/Sell” button from your Coinbase dashboard.

Step 4: Click the “Buy/Sell” button from your Coinbase dashboard.

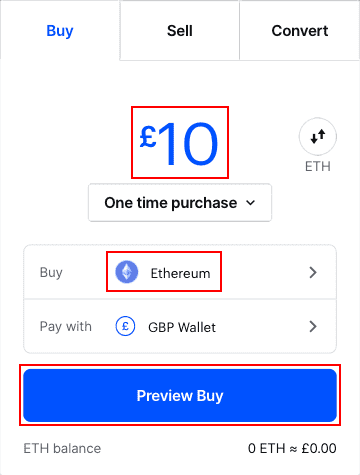

Step 5: Select Ethereum, add the amount you want to buy and click “Preview Buy”. Note: £10 is just an example. You’ll probably need to deposit more relative to what you want to buy. Even to claim a free NFT, gas can cost £50+ depending on network demand at the time.

Step 5: Select Ethereum, add the amount you want to buy and click “Preview Buy”. Note: £10 is just an example. You’ll probably need to deposit more relative to what you want to buy. Even to claim a free NFT, gas can cost £50+ depending on network demand at the time.

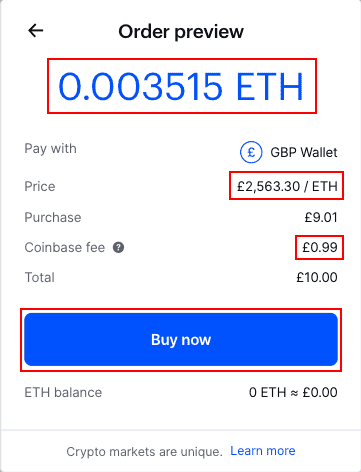

Step 6: Note how much ETH you’ll receive, check the exchange rate and fees. If you’re happy to proceed, click “Buy now”.

Step 6: Note how much ETH you’ll receive, check the exchange rate and fees. If you’re happy to proceed, click “Buy now”.

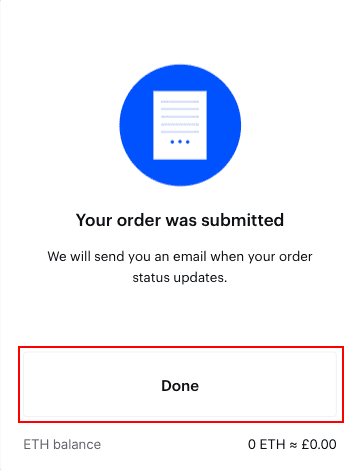

Step 7: Click “Done”. Coinbase will send you an email when your ETH is ready.

Step 7: Click “Done”. Coinbase will send you an email when your ETH is ready.

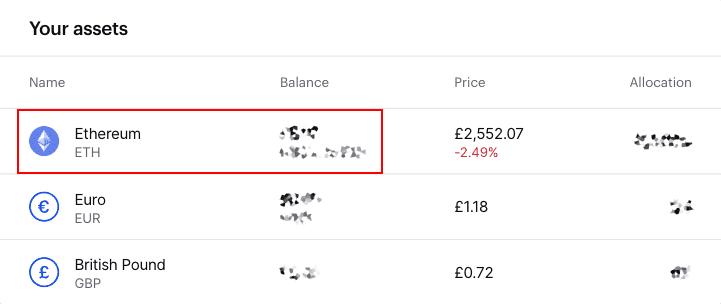

Post exchange, your ETH should appear in your account balance right away. You now have ETH to buy NFTs with!

Step 8: Your Ethereum balance will update once your exchange has cleared.

Step 8: Your Ethereum balance will update once your exchange has cleared.

Be aware that some UK banks are blocking payments to crypto exchanges. Some are picking and choosing who they approve of, others, like Natwest (in the UK), have a blanket ban in place at the time of writing. This can render buying cryptocurrencies tricky.

Revolut have a banking app that makes sending money to crypto exchanges easier.

Revolut have a banking app that makes sending money to crypto exchanges easier.

You can solve the aforementioned problem by opening an account with a crypto-friendly bank. Revolut is a great option because they set you up in minutes. You can then transfer funds from your crypto-unfriendly bank account to your crypto-friendly one. Then deposit from your crypto-friendly bank to your crypto exchange of choice.

Add Funds To Your Crypto Wallet

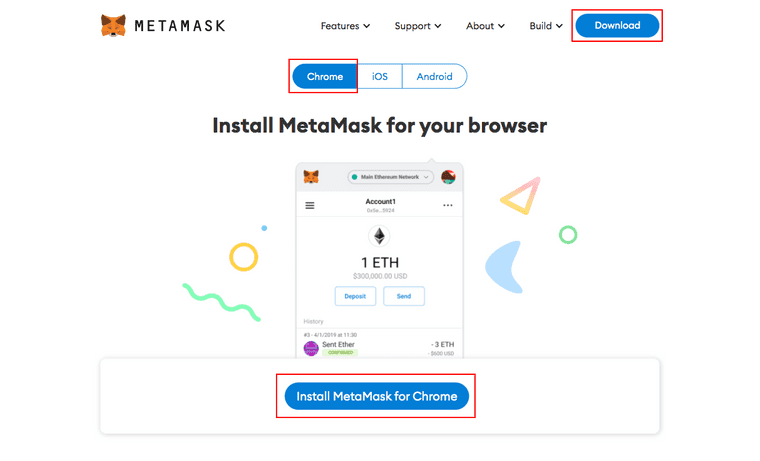

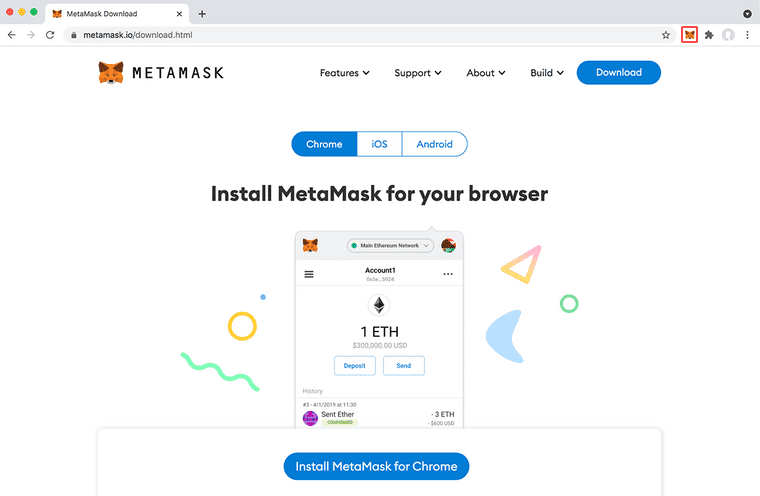

Next, you need to get a crypto wallet. The easiest to start with is MetaMask, a browser extension for Chrome. Most decentralised apps (or “dApps”) like project minting websites work with MetaMask, too.

Step 9: Download the MetaMask Chrome extension that gives you an easy to use Ethereum wallet for buying NFTs.

Step 9: Download the MetaMask Chrome extension that gives you an easy to use Ethereum wallet for buying NFTs.

I’d recommend using MetaMask on desktop as the mobile app has always proven buggy to me. Plus, when attempting a transaction, I’ve always felt less in control and more prone to making a mistake. (If you’re looking for a mobile Ethereum wallet, Rainbow is solid.)

Once you’ve installed MetaMask, click the browser extension icon (it’s an illustrated fox) to open up a small window.

Step 10: Once you’ve installed MetaMask, click the browser extension icon (it’s an illustrated fox) to get started.

Step 10: Once you’ve installed MetaMask, click the browser extension icon (it’s an illustrated fox) to get started.

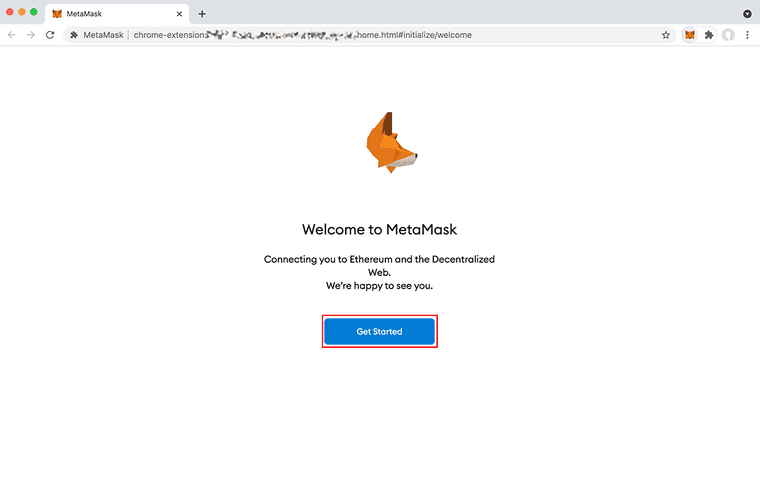

Step 11: Clicking the MetaMask icon for the first time will prompt you to start a new wallet.

Step 11: Clicking the MetaMask icon for the first time will prompt you to start a new wallet.

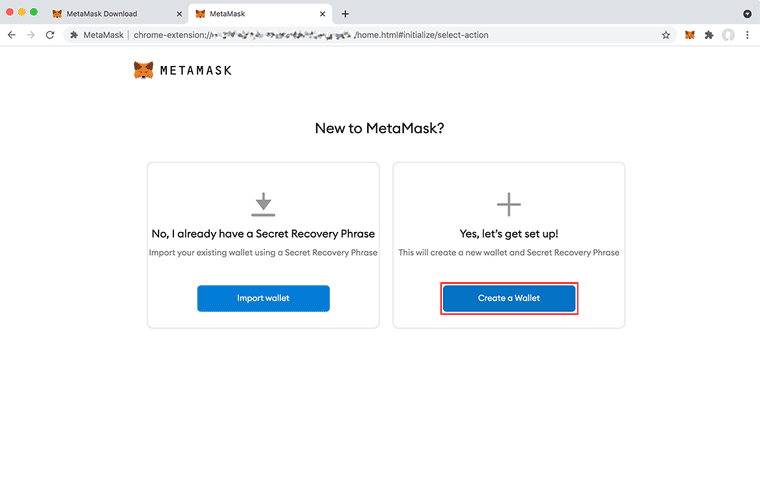

Step 12: Assuming you don’t have a wallet you want to import, click “Create a Wallet” to start one from scratch.

Step 12: Assuming you don’t have a wallet you want to import, click “Create a Wallet” to start one from scratch.

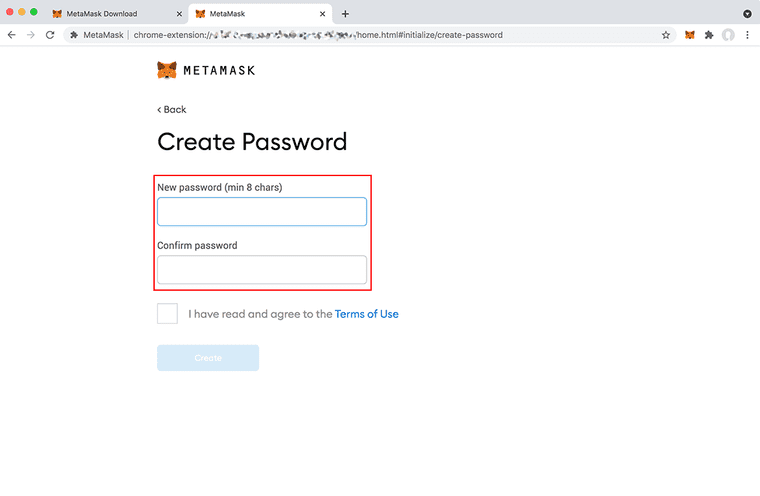

Step 13: Add a password for your MetaMask wallet. Pick something strong. 1Password have a strong password generator that you can use.

Step 13: Add a password for your MetaMask wallet. Pick something strong. 1Password have a strong password generator that you can use.

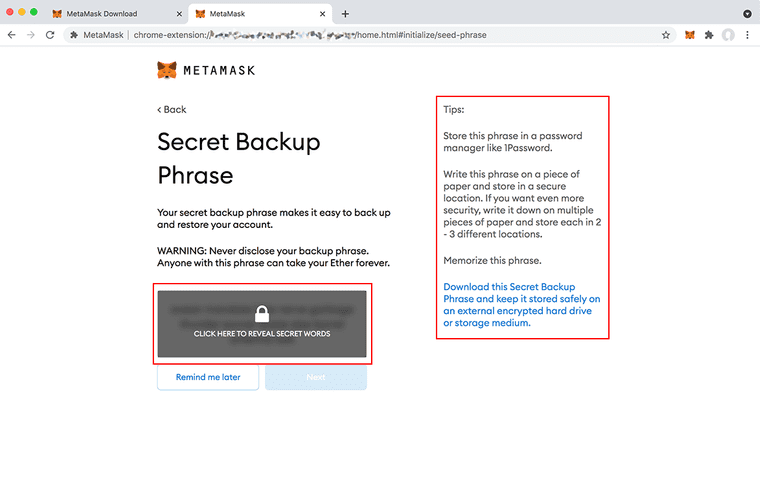

Step 14: This step is important. MetaMask will give you a series of words that make up your secret phrase. This acts as the only recovery system for your wallet. Anyone with this information can gain access to your wallet, your ETH and your NFTs. So guard it closely and never share it with anyone. Take noticed of the tips on this screen before you proceed to keep your secret phase safe.) that you can use.

Step 14: This step is important. MetaMask will give you a series of words that make up your secret phrase. This acts as the only recovery system for your wallet. Anyone with this information can gain access to your wallet, your ETH and your NFTs. So guard it closely and never share it with anyone. Take noticed of the tips on this screen before you proceed to keep your secret phase safe.) that you can use.

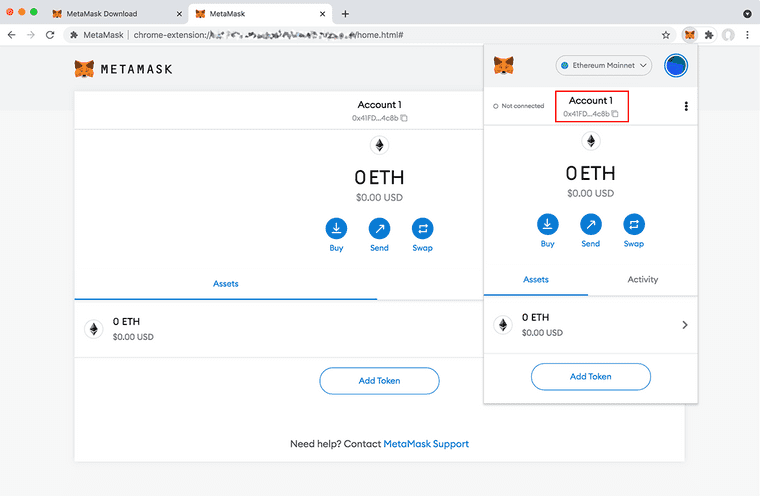

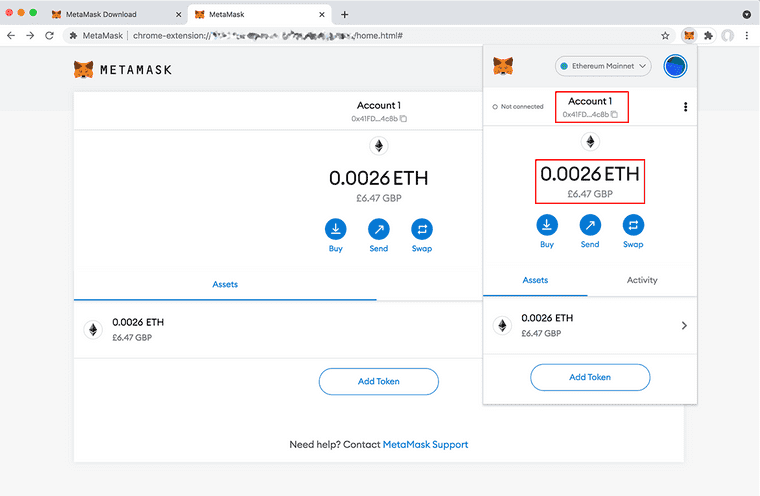

Step 16: After completing a simple game to confirm your secret phase has been noted, MetaMask will present your empty wallet. You can view this page in the whole browser window or as a pop up window the next time you click the fox icon. The hash below your account name is your wallet address. Clicking this copies it to your clipboard.

Step 16: After completing a simple game to confirm your secret phase has been noted, MetaMask will present your empty wallet. You can view this page in the whole browser window or as a pop up window the next time you click the fox icon. The hash below your account name is your wallet address. Clicking this copies it to your clipboard.

You now have a MetaMask wallet! Now you need to fund it with ETH. Once you have the address on your clipboard, log back in to your Coinbase account.

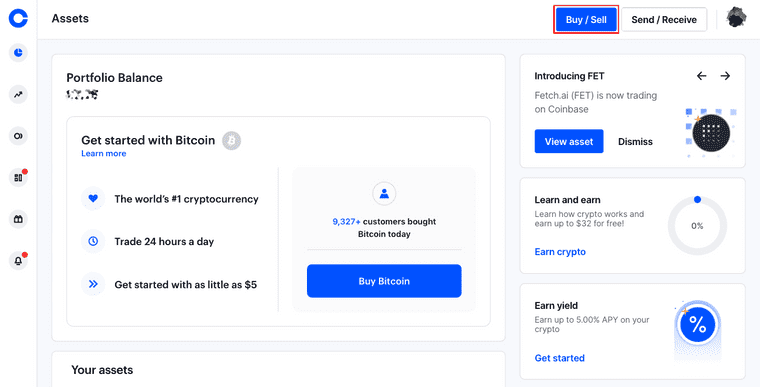

Step 17: Click the “Send / Receive” button from the Coinbase dashboard.

Step 17: Click the “Send / Receive” button from the Coinbase dashboard.

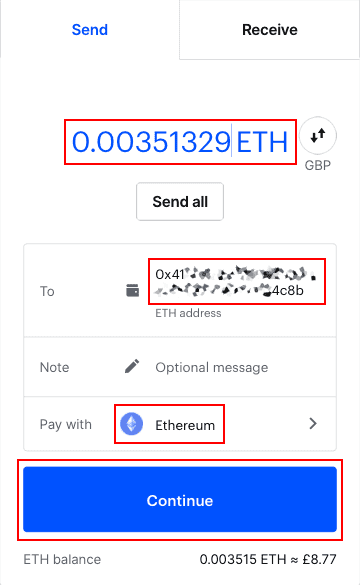

Step 18: Next, add select to pay with Ethereum. Then type the amount of ETH you want to send to your MetaMask wallet, and then your MetaMask wallet’s address. Once you’ve checked the wallet address you’ve entered, click “Continue”.

Step 18: Next, add select to pay with Ethereum. Then type the amount of ETH you want to send to your MetaMask wallet, and then your MetaMask wallet’s address. Once you’ve checked the wallet address you’ve entered, click “Continue”.

Remember to check and double check that the address you’ve pasted into the Coinbase send form and your MetaMask wallet address match 100%. This is important. You’ll not be able to recover funds should you make a mistake.

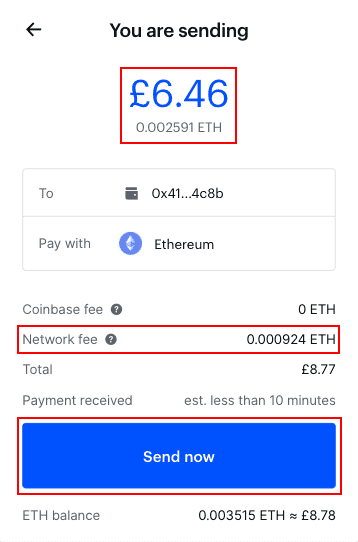

Step 19: Coinbase will show you how much gas it will cost to send the ETH. Network transaction fees are not linked to the amount of ETH sent, so it usually makes sense to send currency in larger chunks. If you’re happy with what it will cost to send, and what your MetaMask wallet will subsequently receive, click “Send now”.

Step 19: Coinbase will show you how much gas it will cost to send the ETH. Network transaction fees are not linked to the amount of ETH sent, so it usually makes sense to send currency in larger chunks. If you’re happy with what it will cost to send, and what your MetaMask wallet will subsequently receive, click “Send now”.

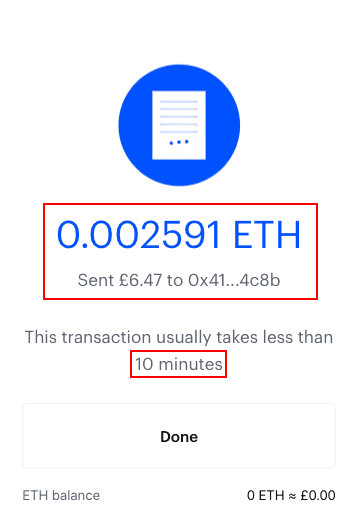

Step 20: The final total of ETH should be in your MetaMask wallet within a few minutes.

Step 20: The final total of ETH should be in your MetaMask wallet within a few minutes.

Remember to check and double check the address you’ve pasted into the transfer form and your MetaMask wallet address match 100%. This is important. You’ll not be able to recover funds should you make a mistake.

Step 21: Your ETH total in your MetaMask wallet will automatically increment once the transfer arrives.

Step 21: Your ETH total in your MetaMask wallet will automatically increment once the transfer arrives.

You now have everything in place to make your first NFT purchase.

Buying Your First NFT on OpenSea

Opening up an NFT marketplace for the first time can be daunting. There’s a wealth of options to pick from. For your first purchase, it’s best to pick something that you like the look of and assume that you won’t make you anything.

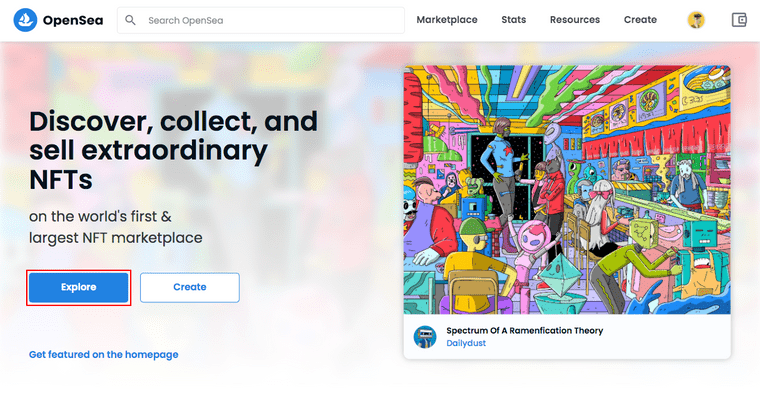

You can purchase NFTs for anywhere between next to nothing and millions on OpenSea. How much you choose to spend is relative to how much you’re willing to invest overall. My advice, at this early stage, is to have low expectations and see any cost as a tuition fee. Let’s start by heading to OpenSea.

Step 22: Click the “Explore” button to view all assets for sale.

Step 22: Click the “Explore” button to view all assets for sale.

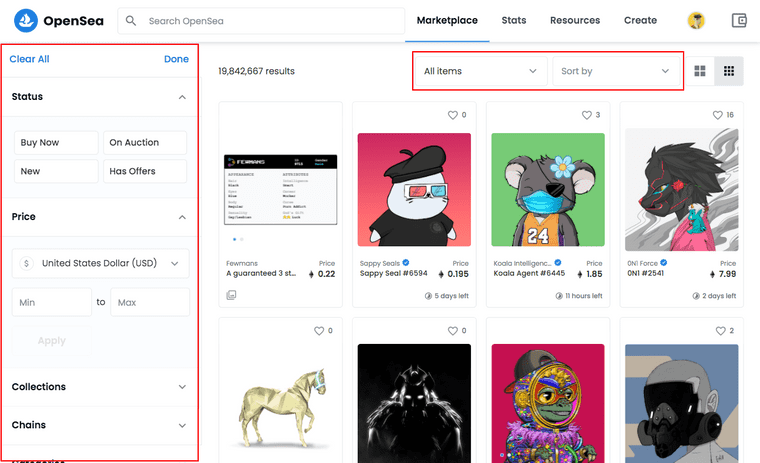

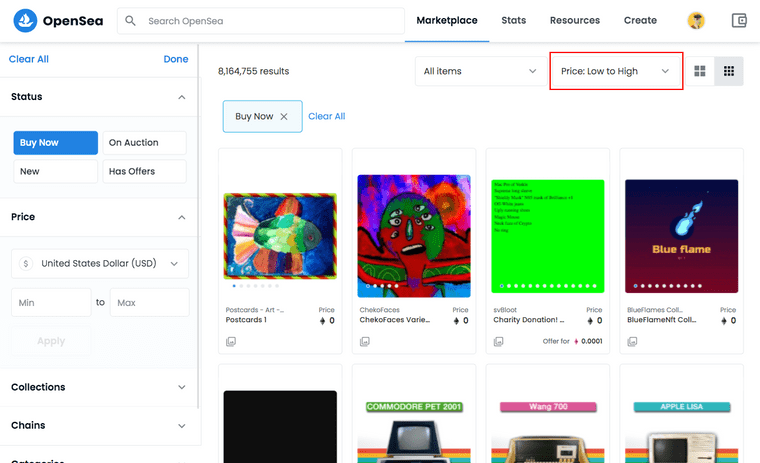

At the time of writing there are nearly 20 million NFTs listed on OpenSea. To filter this down to items that suits your taste and budget, turn your attention to the sidebar filters and top right sorting options.

OpenSea’s filtering options makes narrowing down NFTs to something that will suit your taste and budget easy.

OpenSea’s filtering options makes narrowing down NFTs to something that will suit your taste and budget easy.

OpenSea offers 3 ways to put NFTs up for sale. Sellers can list as an auction to the highest bidder with an expiry date, or, with a fixed purchase price until purchased or cancelled. All NFTs on the marketplace can be bid on. An owner doesn’t have to list their NFT for sale for it to appear on OpenSea. They grab the token’s information directly from the smart contract on the blockchain.

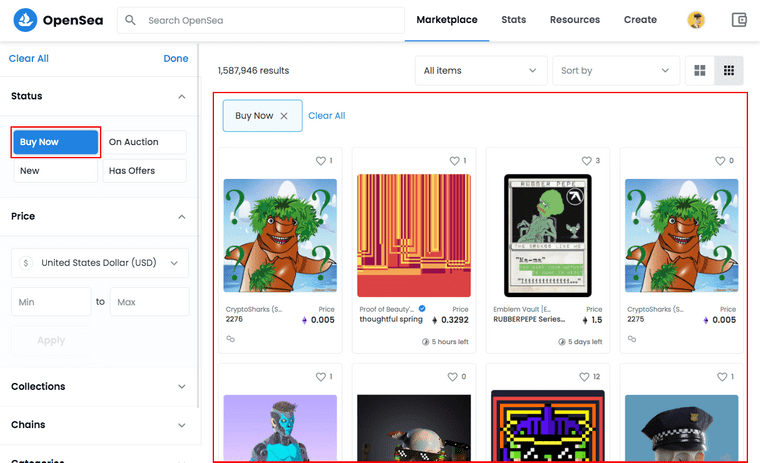

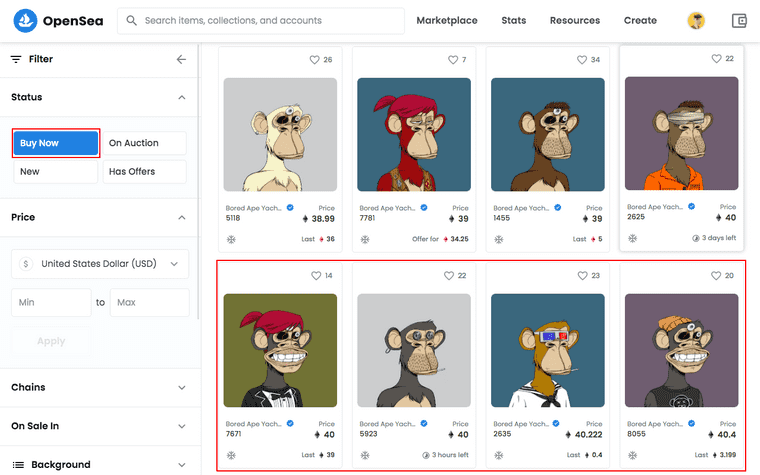

In this walkthrough, we want to buy right away. Activating the “Buy Now” filter will show you the NFTs that sellers have given fixed prices to. Paying the price listed means you’ll take ownership of the NFT right away.

Filter the asset list by clicking “Buy Now”. You’ll notice the total number of NFTs decrease.

Filter the asset list by clicking “Buy Now”. You’ll notice the total number of NFTs decrease.

You can further filter the NFTs through sorting. Here you can check out the most recently listed, most viewed and most favourited assets. The sort method to apply for your first NFT purchase is “Price: Low to High”. This combination will show you the cheapest NFTs that are available to buy now.

Further filter the asset list by selecting the “Price: Low to High” sort order.

Further filter the asset list by selecting the “Price: Low to High” sort order.

You might even find something you like for free. Just bear in mind that you’ll still have to pay a gas fee. Should you wish to spend more, the “Price” filter is a useful feature. Set the currency to ETH, then enter the “Min” and “Max” amounts you’d like to spend. For example, you might want to spend between 1 and 2 ETH.

![https://opensea.io/assets?search[priceFilter][symbol]=ETH&search[priceFilter][min]=1&search[priceFilter][max]=2&search[sortAscending]=true&search[sortBy]=PRICE&search[toggles][0]=BUY_NOW https://opensea.io/assets?search[priceFilter][symbol]=ETH&search[priceFilter][min]=1&search[priceFilter][max]=2&search[sortAscending]=true&search[sortBy]=PRICE&search[toggles][0]=BUY_NOW](/static/4b0cae8bd8abbc5804b0eff873909a3c/db64a/61.png) OpenSea lets you set price restraints to suit your budget when searching for NFTs.

OpenSea lets you set price restraints to suit your budget when searching for NFTs.

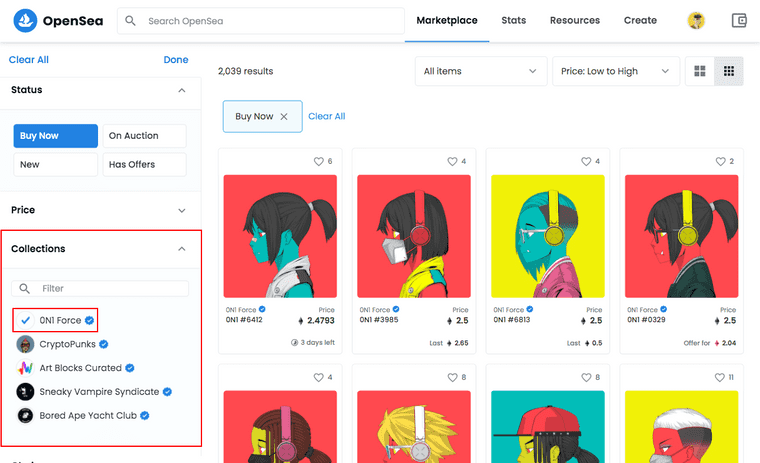

If you’re an investor who knows which project they’d like to buy from, “Collections” is a useful filter. Let’s say you want to buy an NFT from the 0n1 Force collection. Stacking your previous filters and selecting 0n1 Force, will show you all assets in this collection that you can buy now within your price limits; from lowest price to highest price. The lowest priced item here is called the project “floor”. Buying in here is the cheapest way to gain exposure to a project that you like the look of.

Filtering down to a specific collection, alongside “Buy Now” and “Price: Low to High” allows you to see the cheapest NFTs in a set.

Filtering down to a specific collection, alongside “Buy Now” and “Price: Low to High” allows you to see the cheapest NFTs in a set.

Once you’ve identified the asset that you want to purchase, it’s time to pay for it.

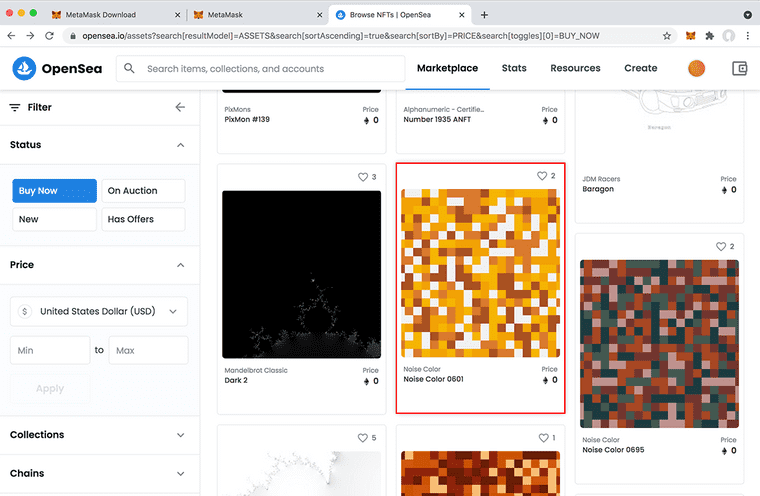

Step 23: Click on the NFT you want to buy.

Step 23: Click on the NFT you want to buy.

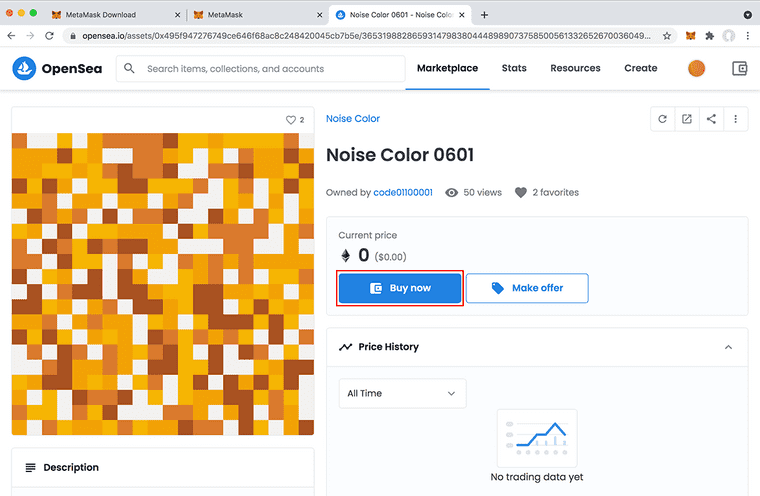

On the single NFT page, you can see additional details about the asset. Price and ownership history are both pulled from blockchain to assist your purchasing decision (if available).

Step 24: If you’re all set, click the “Buy” button.

Step 24: If you’re all set, click the “Buy” button.

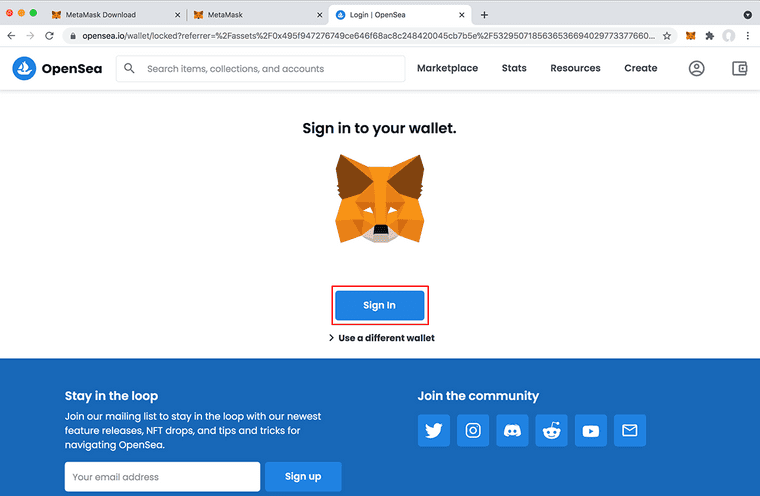

Step 25: If you haven’t already signed into OpenSea with MetaMask, you’ll be promoted to connect your wallet.

Step 25: If you haven’t already signed into OpenSea with MetaMask, you’ll be promoted to connect your wallet.

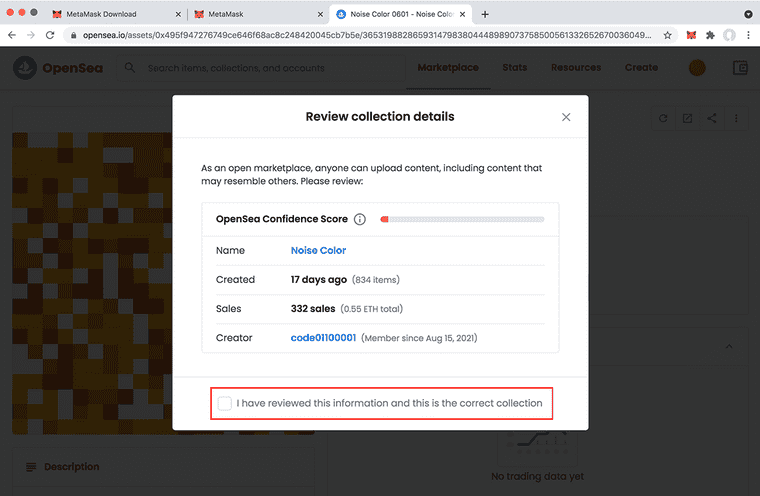

Step 26: OpenSea add a step to the checkout process to help ensure you’ve done your due diligence on your purchase. Because this is our first NFT purchase (and this one is free aside from gas), we’re happy to proceed based on our research. OpenSea’s confidence rating is certainly worth baring in mind when transacting for meaningful amounts.

Step 26: OpenSea add a step to the checkout process to help ensure you’ve done your due diligence on your purchase. Because this is our first NFT purchase (and this one is free aside from gas), we’re happy to proceed based on our research. OpenSea’s confidence rating is certainly worth baring in mind when transacting for meaningful amounts.

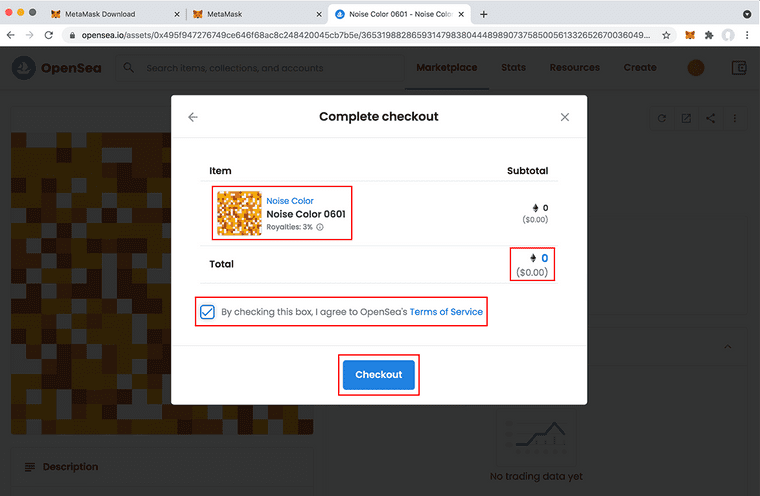

Step 27: After checking the final price and OpenSea’s terms of service, initiate the confirmation of your transaction by clicking “Checkout”.

Step 27: After checking the final price and OpenSea’s terms of service, initiate the confirmation of your transaction by clicking “Checkout”.

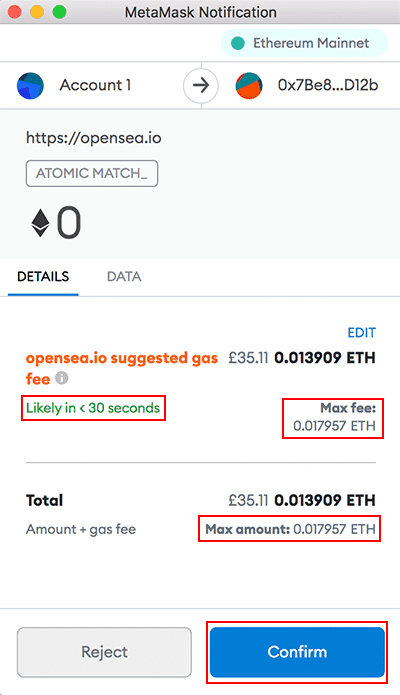

Step 28: Next, a MetaMask window will pop-up. This is where you finally confirm your transaction. Take note of the speed which your transaction will go through and the max gas fee you’ll pay for it. Finally, check the total max price (NFT price + max gas fee). If you’re happy to proceed, click “Confirm”. Note: There’s no going back from this point.

Step 28: Next, a MetaMask window will pop-up. This is where you finally confirm your transaction. Take note of the speed which your transaction will go through and the max gas fee you’ll pay for it. Finally, check the total max price (NFT price + max gas fee). If you’re happy to proceed, click “Confirm”. Note: There’s no going back from this point.

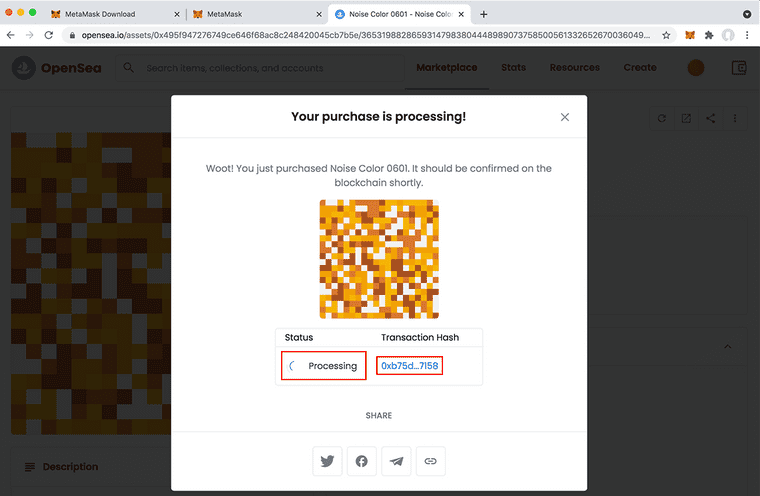

Step 29: The MetaMask pop-up will close after signing, and your purchase will start processing via the Ethereum blockchain. Tip: If you want to see the transaction’s progress on Etherscan, click the hash link.

Step 29: The MetaMask pop-up will close after signing, and your purchase will start processing via the Ethereum blockchain. Tip: If you want to see the transaction’s progress on Etherscan, click the hash link.

Step 30: After a little while, your transaction will complete. This is usually in line with the estimate time quoted in MetaMask pre-confirmation.

Step 30: After a little while, your transaction will complete. This is usually in line with the estimate time quoted in MetaMask pre-confirmation.

Congratulations, you own an NFT!

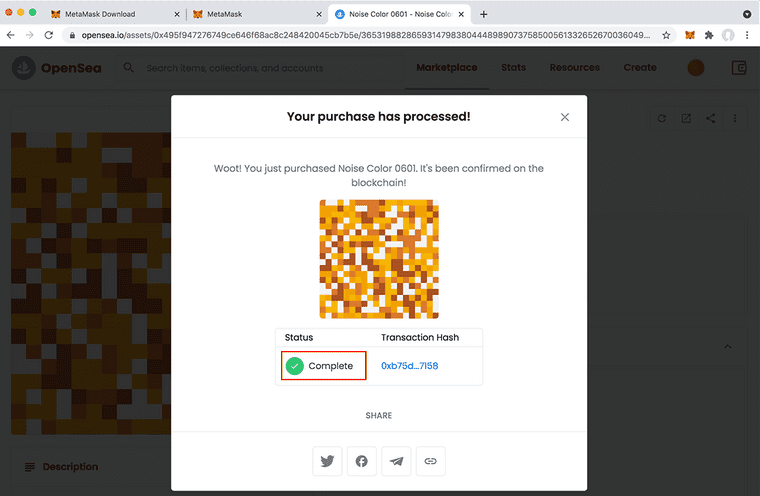

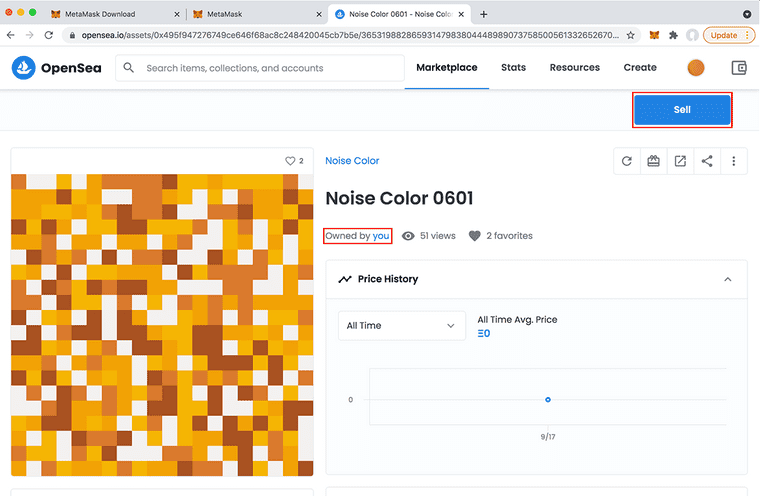

Step 31: To view the new NFT within your collection, click your avatar in OpenSea’s top navigation bar. You’ll be taken to the “Collected” tab where you’ll see the token you now own.

Step 31: To view the new NFT within your collection, click your avatar in OpenSea’s top navigation bar. You’ll be taken to the “Collected” tab where you’ll see the token you now own.

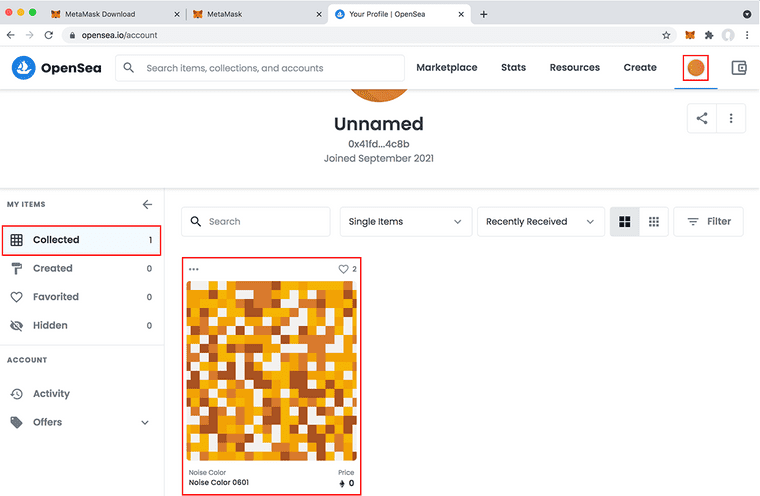

Step 32: Click on the MetaMask fox icon. You’ll notice that your ETH balance has reduced based on what you paid for the NFT. You’ll also see the OpenSea transaction in your activity log.

Step 32: Click on the MetaMask fox icon. You’ll notice that your ETH balance has reduced based on what you paid for the NFT. You’ll also see the OpenSea transaction in your activity log.

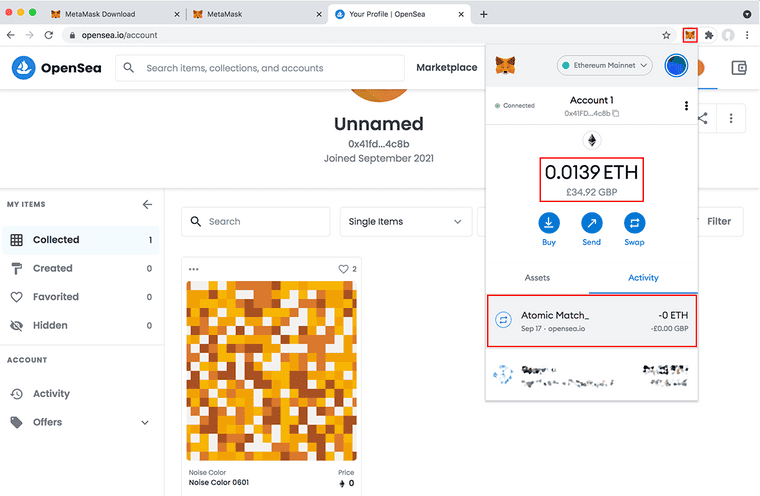

Step 33: Clicking the transaction will show it’s details, including the final gas fee paid and the total fee paid.

Step 33: Clicking the transaction will show it’s details, including the final gas fee paid and the total fee paid.

If you ever want to sell your NFT, you can use OpenSea to do this. When viewing the asset as it’s (logged-in with MetaMask) owner, you’ll have all the same options to sell as other creators.

You’re free to sell your first NFT whenever you want on OpenSea. Just like how you bought it.

You’re free to sell your first NFT whenever you want on OpenSea. Just like how you bought it.

Picking Profitable NFTs

With new projects arriving daily, it’s important to consider the fundamentals alongside your tolerance to, and capacity for, risk. Here are a few things to consider before you buy.

Only invest what you can afford to lose.

Define Profitable

What does profitable mean to you? When investing time and money into something new, you need to consider what you’re looking for in return.

The interesting thing about NFTs is they converge many fields:

- Code

- Culture

- Community

- Investing

- Collectables

- Collaboration

So you need to determine what kind of NFT buyer you are:

- Are you in it for the art?

- Is community important to you?

- Do you just want to make money?

- Do you want to use NFTs as a vehicle to explore crypto?

- Are you looking to participate in a project on paid terms?

- Are you investing long-term or are you short-term trading?

Take time to ask yourself questions like these. It’s important to know what game you’re playing before making purchasing decisions.

There are several ways for NFTs to provide value. Be aware of your goals to ensure you’re getting a sufficient return.

Taste

Think about your personal taste and the communal taste of collectors in the space. Do you like how the art that the token represents looks? What’s the general consensus?

The perspective of the market matters for your NFT to retain value. But if you’re less of a speculator, you have to be comfortable holding an NFT even if it becomes worthless on paper. That’s why buying art you connect with is key.

Here’s a simple eye-test to follow:

- Is the art well-drawn?

- Is it free of layering errors?

- Is it aesthetically appealing?

- Would you hang it on your wall?

- Would you use it as your profile picture on social media?

If your primary profitability metric is the art itself, then personal taste is the fundamental that matters most.

Projects Of Significance

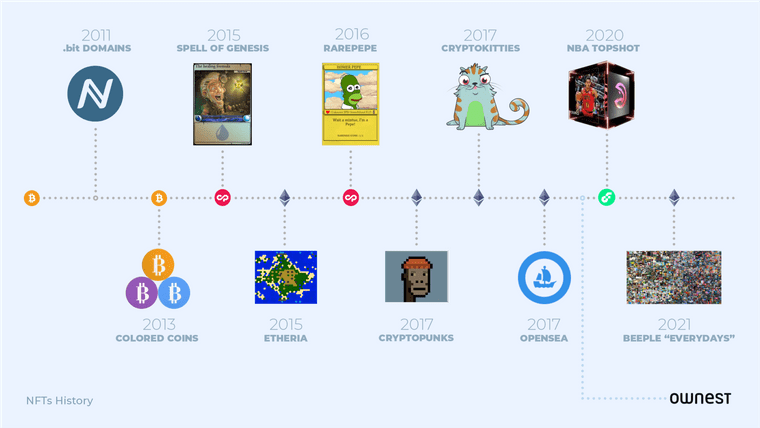

Did the project mark a point of significance in the NFT space? For example, CryptoPunks—with Rare Pepes before them and CryptoKitties soon after—hold value for being one of the earliest NFT projects to market.

The history of NFTs. Image from Ownest

The history of NFTs. Image from Ownest

Newer projects like Bored Ape Yacht Club, launched in May 2021, have proven significant for their extreme success. BAYC, in particular, created a wave of however-many-thousand piece profile picture projects soon after. Though the quality of subsequent releases varied, this is considered a crucial moment in time by the NFT community. Since for mass adoption the technology, we’ll need more NFTs.

Projects from the emerging wave like CrypToadz by Gremplin, Cool Cats, Gutter Cat Gang and Pudgy Penguins are now writing their own history.

Project Mechanics

The age of a project isn’t the only thing that can make it significant. Alternative mechanics can differentiate it too.

What’s a mechanic in an NFT project sense? It might be:

- The number of NFTs to be minted

-

How the release of NFTs is structured

- Mint pass (buy an NFT to have access to the future NFT)

- Pre-mint (reward active community members with early access)

- In batches (stagger the release of NFTs)

- Inflationary supply (more NFTs appear over time, or forever)

- Deflationary supply (allow NFT holders to burn their token in exchange for something else of value)

- Project converts to a DAO with token governance (assign NFT holders tokens that work as votes that can be bought/staked/sold)

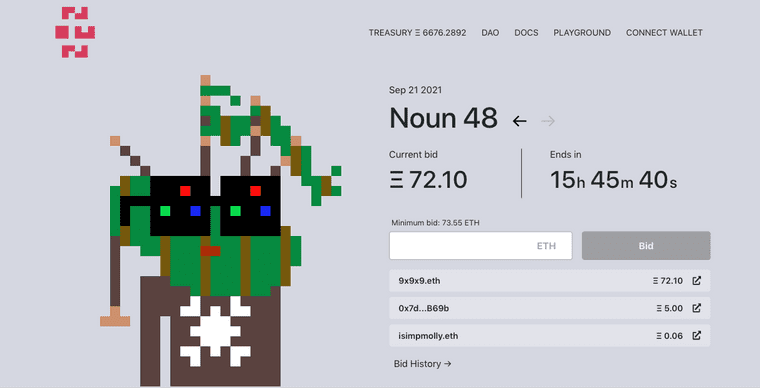

With most NFTs being part of PFPs or 1 of 1 pieces, those that take advantage of more interesting mechanics stand out. The Nouns project, that mints “One Noun, every day, forever” has raised 11,190 ETH ($44,583,086 at the time of writing) for its community treasury so far.

The history of NFTs. Image from Ownest

The history of NFTs. Image from Ownest

Cultural Relevance

Cultural relevance is hard to measure. We can look at the art itself and judge whether it’s on point for the times—have 3D glasses ever been in fashion? Or, we can look at the bigger picture: is the NFT marketed in a way that a buying audience can relate to?

Oftentimes, if there’s a portion of truth to a collection’s narrative, it’ll hit home. Take BAYC. It’s less about the cartoons and more about the story; A swap club for bored apes, or, a Discord server for a generation of internet-natives looking for entertainment. The Bored Apes are us.

A project has more chance of success when it relates to its target audience. As culture shifts increasingly online, much is shaped on social media. In a world where attention is scarce, an NFT that connects quickly visually, can help it become a mainstay.

Chubbicorns use community created memes on Twitter to increase the value of their project.

Chubbicorns use community created memes on Twitter to increase the value of their project.

If a project becomes culturally relevant, you can bet on it to hold its value. In short, is the NFT you’re considering meme-able?

Team Credibility

If you’re looking at buying NFTs as investments, liken it to any other investment. For instance, if you were to buy Apple stock, you’d do so because you believe in the company’s future potential due to their track record. Or if you were to back an early stage startup, you’d do so because you believed in the founders.

As the barrier to minting NFTs lowers, it’s important to understand the team running the projects you’re interested in.

The nature of crypto allows projects to be launched anonymously. While this isn’t always a bad thing for a buyer—pseudonymous personas can build credibility too—it’s easier for project founders to make a swift exit and nullify all promises to their holders. This is known as a “rug pull”.

Do your due diligence before buying an NFT you’re looking to make a return on:

- Check that the project has website.

- Does it look well put together?

- Does the website have a team page?

- Who’s on the team?

- Are they named or anonymous?

- What have the done before?

- Are they credible on Twitter?

- Are they credible on Discord?

- Do they have skin in the game?

“Aping in” (buying an NFT in the spur of the moment) can be exciting, but it’s an easy way to be left holding the bag. Know who’s behind what you’re buying.

Future Incentives

In a move akin to the startup world, NFT projects often entice buyers with the hope of future returns. Like startups, this can be financial. But unlike startups, this can be access to additional art or real estate in the metaverse.

Treeverse, by Loopify, sold Founder’s Plot NFTs which will relate to in-game land on release.

Treeverse, by Loopify, sold Founder’s Plot NFTs which will relate to in-game land on release.

When considering an NFT, look at what the project promises:

- Is it useful to you?

- Do the features look farfetched?

- How much confidence do you have in the team to deliver?

A roadmap is like a story. It’s important to know what’s planned to firm up your beliefs. But remember that a roadmap is only as good as the team executing it. There are no guarantees that incentives will be delivered on.

Momentum

In NFTs, there are two main types of momentum:

- The build pace of the team behind a project

- The frequency, or volume, of transactions

The former indicates that the project is still in active development. If a roadmap was promised, this is being executed and additional features are being delivered.

Start by checking the Discord server and Twitter account of the project. Assess the founding team’s activity. There will usually be an “announcements” (or similar) channel in Discord where updates are posted. Updates are often shared on Twitter, too. Check the care and attention that are put into these.

Some NFT projects are released without a roadmap. Just for the art and perhaps community access. Tracking momentum in this case can be done by:

- Following community sentiment. Is the project still talked bout? Is it still relevant?

- Sales. Are people still trading? Will there be liquidity for you to exit should you wish to?

Be wary of artificial momentum. Hype is usually at it’s highest when an NFT project launches. Everyone is trying to get in. You might even see a few high profile buyers. People with large followings are sometimes paid to promote new projects which can prove any initial traction to be somewhat artificial.

Organic, longer-term momentum is what you’re looking for; momentum that comes as a result of the quality of an NFT’s art, the expertise of its creators and the passion of the project’s community.

Liquidity

It makes sense to buy NFTs from projects that have liquidity. If no one is selling, no one can buy and if everyone is selling, few will want to buy. Like any market, an NFT project needs a balance to prove healthy.

NFTs are inherently an illiquid asset, meaning, they’re not the easiest investment to cash out of. For instance, it’s all well and good that you think your Adjective Animal is worth 10 ETH; but it’s irrelevant if there’s no buyer for it.

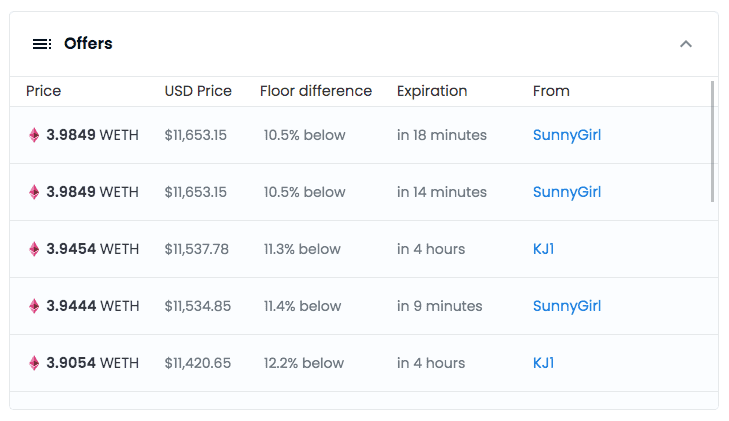

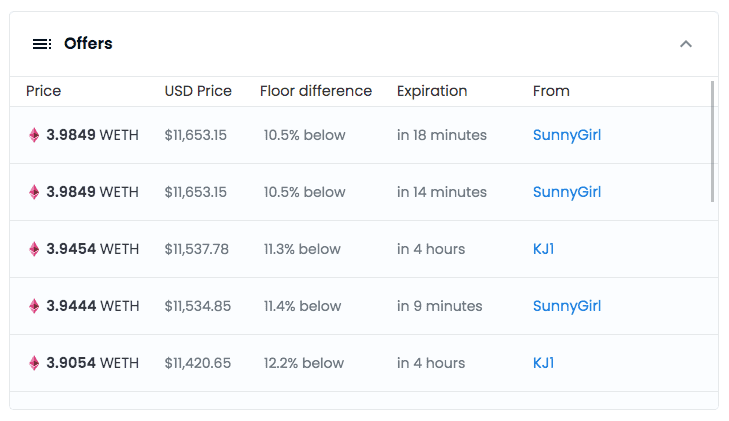

One way to check whether you’d be able to sell an NFT should you wish to, is it check the offers against it on OpenSea. Many of these are from automated bots, who often lowball, the fact that they’re there is a strong signal that the market is liquid. Why? Because these bots want to buy ~10-20% below the floor price and flip them quickly for a profit.

The offers panel on OpenSea paints the liquidity picture of an NFT.

The offers panel on OpenSea paints the liquidity picture of an NFT.

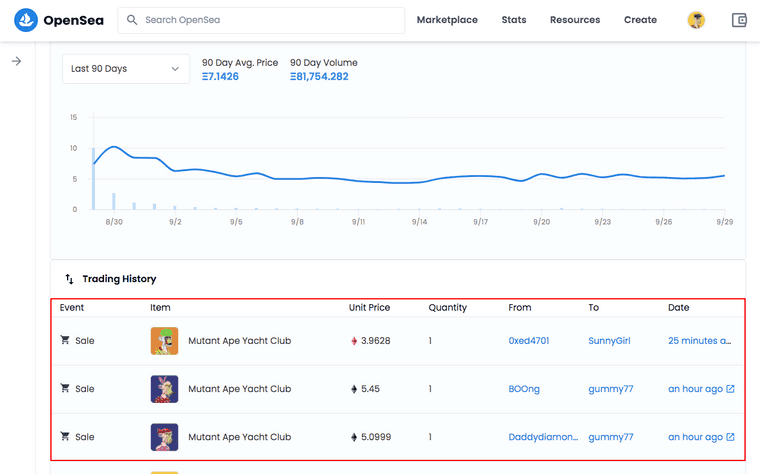

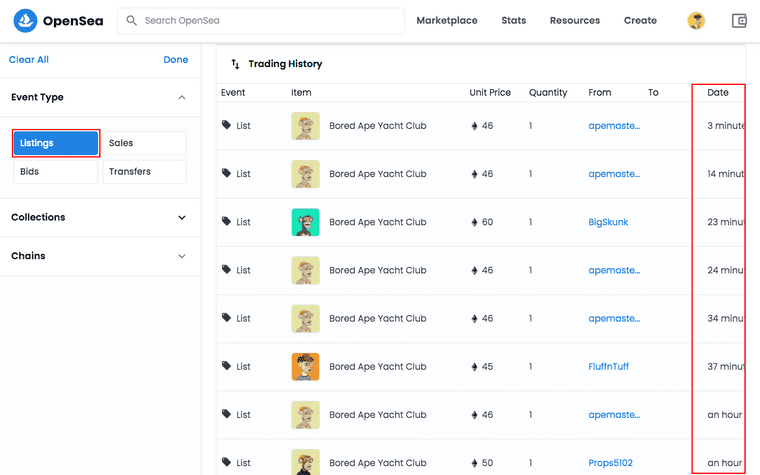

You can use OpenSea to check a project’s activity too. Filter by listings and sales to see if the market is stagnant or moving.

The offers panel on OpenSea paints the liquidity picture of an NFT.

The offers panel on OpenSea paints the liquidity picture of an NFT.

On an OpenSea collection page, click the activity icon.

On an OpenSea collection page, click the activity icon.

Then check recent sales. Here we can see that one was made 25 minutes ago.

Then check recent sales. Here we can see that one was made 25 minutes ago.

Rarity

Before you buy an NFT, it makes sense to check its rarity within the collection. In projects that have random traits, some will be less common than others. This helps collectors form a narrative around scarcity and price.

As a rule of thumb, NFTs with traits (eyes, hats, clothes, etc.) that few within the collection have, are most expensive. Common traits, ones that many NFTs within the collection have, are usually the least expensive.

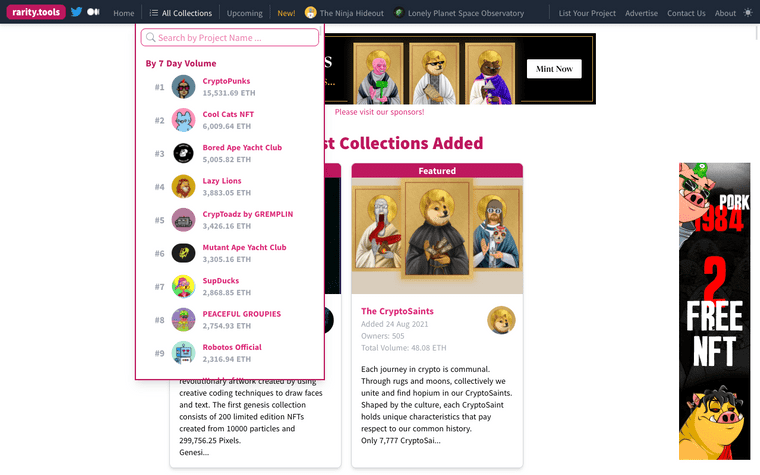

Rarity Tools assesses the statistical rarity of NFTs within their collections.

Rarity Tools assesses the statistical rarity of NFTs within their collections.

Be wary of two things when using rarity to make purchasing decisions. Firstly, some rarity tools judge rarity using different metrics and calculations. Meaning the rarest NFT shown in one tool, might not be the rarest in another.

Secondly, some collectors assign rarity by sentiment, not by what is most statistically rare. One NFT that looks “clean” (plain but visually appealing) might be worth more than one that is actually scarcer when measured. Aesthetic can outrank rarity.

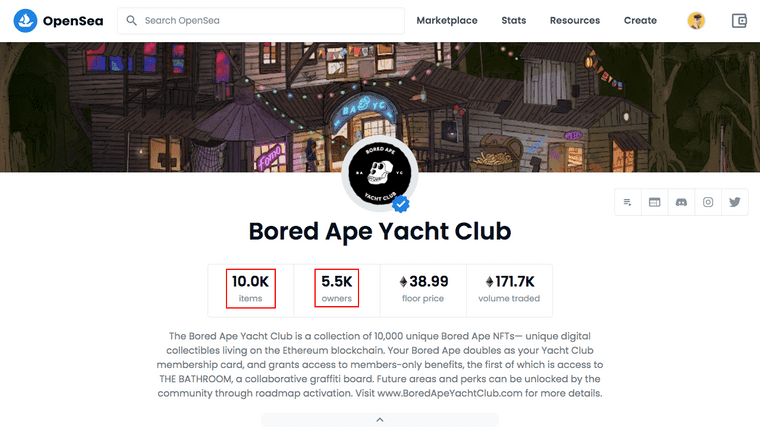

Owner To Token Ratio

A strong community makes a strong NFT collection. Part of how we can measure this is to look at the number of NFTs held by unique wallets.

If there are 10,000 NFTs within a collection, and one person owns 5,000 of them, the other 5,000 individual owners are at the mercy of that one person. They could decide to liquidate all of their NFTs which would lower the value of the remaining 50% in one swoop.

On the flip side, a more even spread of tokens between owners is a desirable feature. Because it’s less likely that individuals will liquidate all at once. It can also mean that more enthusiastic collectors can participate in the community too. Which is conducive to building a strong community, driving long-term value as a result.

~5,000 owners for a 10,000 collection, or ~2 NFTs per owner, is usually seen as a healthy signal.

10,000 Bored Apes are split between 5,500 owners at the time of writing. Each wallet holds 1.81 NFTs.

10,000 Bored Apes are split between 5,500 owners at the time of writing. Each wallet holds 1.81 NFTs.

Historic Price

Consider historic price. While the NFT art explosion is only months old, you can establish the average price of NFTs from a collection by looking at the peaks and troughs on OpenSea.

Of course, the past isn’t a guarantee of what will happen in the future, but a steady price over time can allay stability fears. Especially once the dust settles after a launch.

Many NFT speculators right now aren’t looking for steady gains; rather, a 24-hour 10x flip. However, as the industry ages, historic price will become a metric of greater importance when analysing risk.

Ethereum Price

Because NFTs are priced in ETH, it’s savvy to be aware of its price relative to your local currency. Take an NFT that was 4 ETH in June 2021 and is still 4 ETH in September 2021. The price of 1 ETH then was £1,500 June. But move forwards to September and 1 ETH is valued at £2,500. This makes the same NFT worth £4,000 more in British Pounds from June to September, but the same in ETH.

This can have a knock on effect in the NFT markets. When ETH is high people might look to cash out their NFT gains. When ETH is low, NFTs appear “cheaper” to new investors.

If you want to keep funds in ETH for the long-term, the price is less relevant. If it doesn’t matter that your ETH is tied up, because you have no immediate need for the funds to pay for things you can’t buy in crypto, you probably won’t be price watching so frequently.

Evaluate whether the fiat price of an NFT is meaningful to you. Might you need to cash out? If “yes” keep an eye on the conversion rate so you know what you’re really investing.

You can check the current Ethereum price with Yahoo! Finance.

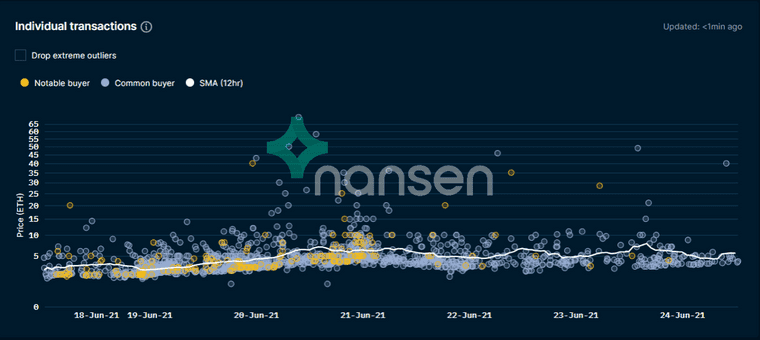

Influential Buyers and Sellers

People will mimic NFT investors with good track records. Just like people will follow Berkshire Hathaway’s trades.

The transparency of the blockchain gives everyone access to what an investor buys and sells. An NFT considered valuable by an influential person, can lead to the wider-market considering it valuable. Having this data quickly to hand offers an edge to those looking to spot NFT projects with potential early.

Be careful with who you consider to be an influential buyer or seller. A longstanding member of the digital art space is likely to have better taste than an influencer just entering it.

If you’re interested in the data behind NFT markets, paid tools like Nansen can help you track influential wallets, identify opportunities and follow the smart money.

Nansen tracks NFTs by project over time and highlights notable buyers.

Nansen tracks NFTs by project over time and highlights notable buyers.

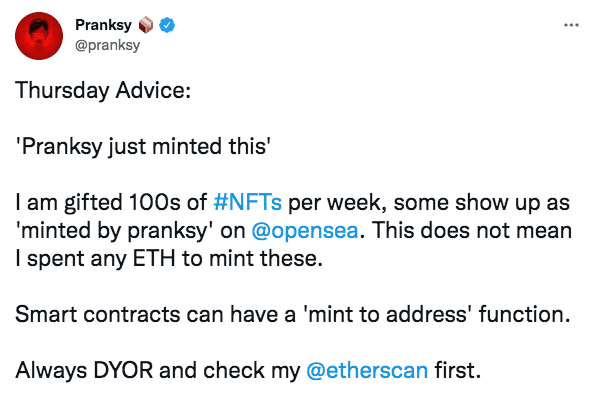

Vibes

If the vibes around something are good, you resonate with it. If you resonate with something, it’s profitable. Ownership should feel good.

To assess the vibe of an NFT project is to trust your gut. Would you ever buy—or give your time to—something that didn’t feel quite right?

After you’ve been in the space for a while, you’ll develop an intuition that will help you make calls. While web3 is making the internet fun again, and it’s exciting to buy NFTs, there will always be bad actors in a quickly developing market.

If the vibes feel off, wait it out. Because in NFTs, “vibes are the new fundamentals”.

Vibes are the new fundamentals by Jack Butcher.

Vibes are the new fundamentals by Jack Butcher.

Early NFT Mistakes To Avoid

Aside from paper handing (letting go too easily) my Bored Ape, I’ve made a few more early mistakes too. Here they are so you can avoid them.

Not Doing Enough Research

Try not to buy things without at least doing some due diligence. The draw to act fast might be strong, but there are things you can do quickly to protect yourself:

- Check that the project you’re buying is the right one. People will often make fake projects on OpenSea with similar names. Look out for the blue checkmark to ensure the project is verified.

- Join the Discord server for the project. How many members do they have? Does it look artificially inflated? What’s the chat like? Make sure it feels natural.

- Look the founders up on Twitter. What’s their track record? When did they join? Does it look like they’ve bought followers? You’re looking for a natural account.

Treat this as a bare minimum and take advantage of the more detailed research techniques in this article to help you make better investment decisions.

Only Buying 1 Piece From A Collection

If you have conviction around a project, it makes sense to buy more than one NFT from the collection. Otherwise, you might have to sell your only piece to take a profit when you don’t want to exit the community. Because staying part of a community carries its own value.

Here are a couple of strategies that can help mitigate this problem:

- Buy two minimum. Should the project take off, sell one to cover the cost of both NFTs and retain one to retain your membership and to have exposure to any larger price rises in the future.

- Buy three minimum. Should the project take off, sell one to cover the cost of all three NFTs. Retain one to sell should there be a price increase in the medium term. Hold one for the long-term to retain your membership and have exposure to any huge price rises in the future.

Fast Floor Rises & Falls

If you list your item for sale be prepared for it to sell. This might sound odd. What’s the point of putting a price on something that you don’t want to sell, right? So I’ll explain with a simple scenario:

Remember, the floor price is the lowest priced piece in an NFT collection. The cheapest entry point.

Let’s say you bought a floor piece for 10 ETH. You’re happy with the NFT, but you’d sell it for 20 ETH should a buyer come along, so that’s what you list it for. Because the floor price is 10 ETH, so 20 ETH would be a great price. Then you go about your week.